Introduction

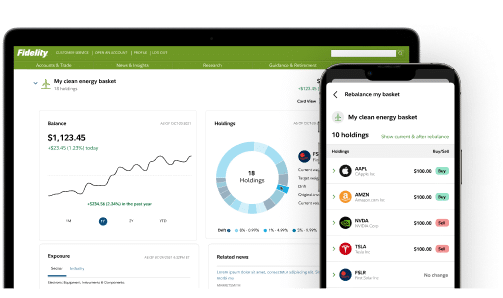

In the complex world of investing, choosing the right broker is crucial. Among the many brokerages in the market today, Fidelity Investments has consistently been a popular choice for many investors due to its robust range of offerings and customer-centric approach. However, like all brokers, it comes with its own set of strengths and weaknesses. This review delves into the intricacies of Fidelity as a broker, presenting a balanced perspective to help you decide if it’s the right choice for you.

Fidelity Investments: A Brief Overview

Established in 1946, Fidelity Investments has grown to become one of the largest and most diversified financial services companies worldwide. Known for its wide range of services including retirement planning, wealth management, brokerage, and more, Fidelity has something to offer for nearly every type of investor.

Pros of Using Fidelity

- Strong Customer Service: Fidelity has earned a strong reputation for its high-quality customer service. It offers extensive customer support, including 24/7 phone support, an online chat feature, and a well-developed FAQ section on its website. This dedication to customer service sets it apart from many other online brokers.

- Tailored for Long-Term Investing: Fidelity is ideal for long-term investors, offering a vast array of mutual funds (including many no-fee options), retirement services, and tools for long-term financial planning. It’s especially popular among retirement savers and investors looking to build diversified, buy-and-hold portfolios.

- Easy Money Transfer: The platform provides easy and efficient methods to transfer money in and out of your account. This includes electronic funds transfer, wire transfer services, and check-writing capabilities.

Cons of Using Fidelity

Despite its strengths, Fidelity is not without its drawbacks. Understanding these will help ensure it aligns with your investing needs and style.

- Not Ideal for Short Selling: Fidelity may not be the best platform for investors interested in short selling. It can be challenging to borrow stocks for short selling, and the process is not as streamlined as with some other brokers.

- Not Meant for Active Trading: While Fidelity offers a broad range of investment options, its platform isn’t tailored for active trading styles such as day trading. The order execution can be slower compared to dedicated day trading platforms, and advanced technical analysis tools might be lacking for active traders.

- High Broker-Assisted Trade Fees: If you need assistance with your trades, Fidelity charges a high fee relative to some competitors. This can add up if you frequently require broker assistance.

- Minimum Investment for Mutual Funds: Many of Fidelity’s mutual funds require a minimum investment, which may be a barrier to investors with smaller amounts of capital.

Conclusion

Fidelity Investments is a robust platform offering a broad range of investment options and strong customer service. Its focus on long-term investing and ease of money transfers makes it a solid choice for buy-and-hold investors and retirement savers.

However, the platform might not be the best fit for everyone. Its limitations for short selling and active trading, coupled with higher broker-assisted trade fees and minimum investment requirements for mutual funds, could be drawbacks for certain investors.

As always, when choosing a broker, it’s essential to consider your unique trading and investment needs. While Fidelity may excel in certain areas, other platforms may be better suited for different trading styles or strategies. Therefore, it’s recommended to thoroughly research and test multiple brokers before settling on the one that best aligns with your financial goals.