We’ve Helped Over 10,000 People Supplement Their Income Trading Stocks

My Investing Club provides professional day trading education for all skill levels, from total beginner to 7-8 figure per year traders.

Check out our 400+ reviews

Rated 5.0 out of 5.0

#FreeWebinar

Take your first class today

The reason 90% of traders fail is improper education. With proper education, it is very possible to achieve the life of freedom and abundance trading provides. Our members prove that every day!

Meet Your Mentors

To be the service our members need us to be, it takes a group of passionate traders. Take a moment to get to know the guys who started it all.

We've been featured on

Our Mission

It is our mission to mentor and guide as many people as possible to become consistently profitable day traders.

When we first started, we wished there was someone to help us. MIC was created to arm traders of all levels with all the necessary tools to achieve success and total financial freedom.

#ConsistenlyProfitable

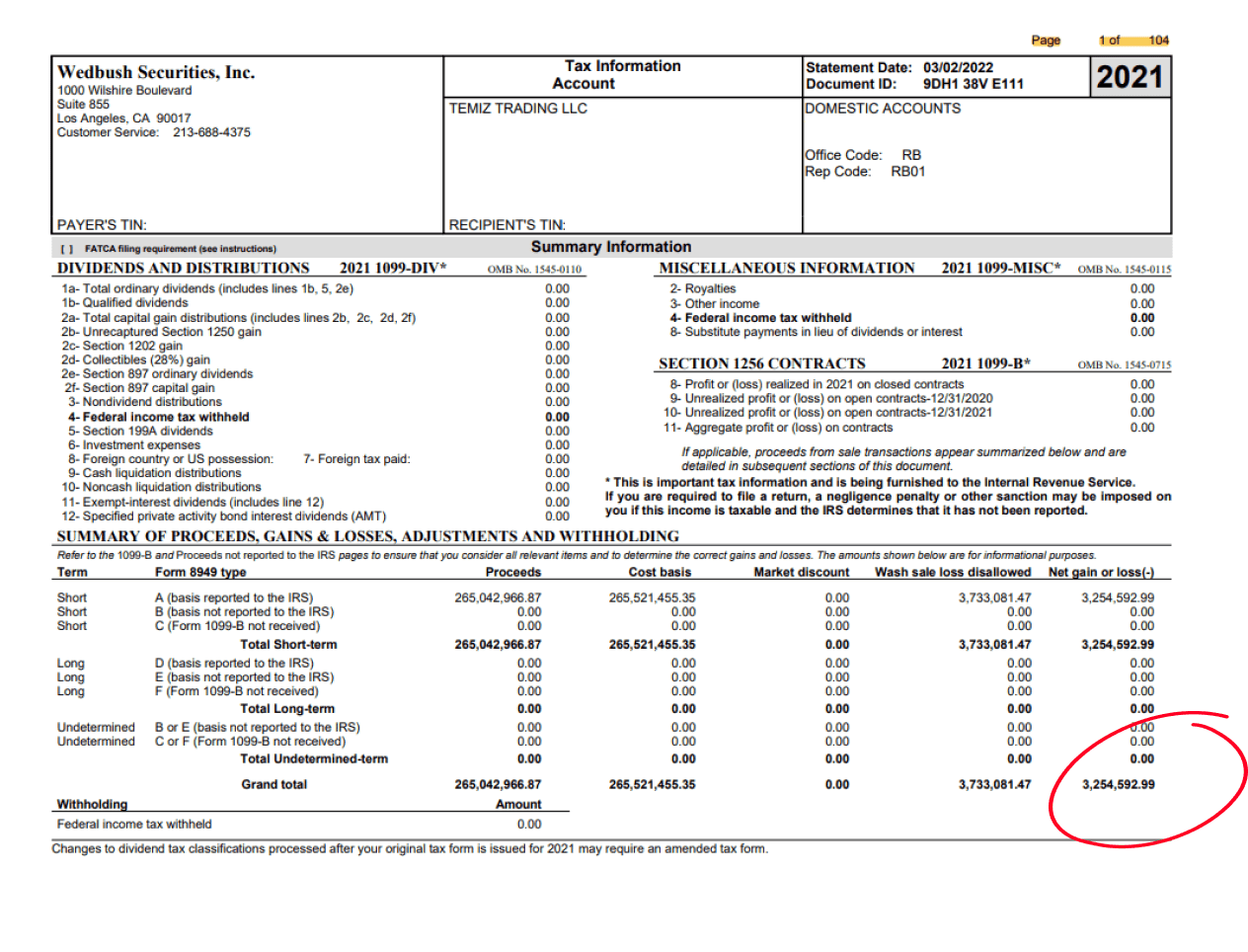

Our Members Are Consistently Profitable

We provide our students with every resource they could possibly need to become successful. From on-demand video lessons to Alex’s personal daily watch lists, live market recap & trader psychology classes, daily education in the chatroom, even 1-on-1 mentorship phone calls with professional day traders, we provide it all.

90% of traders fail. In MIC, you have the opportunity to be in the 10% that succeed.

#Consistency

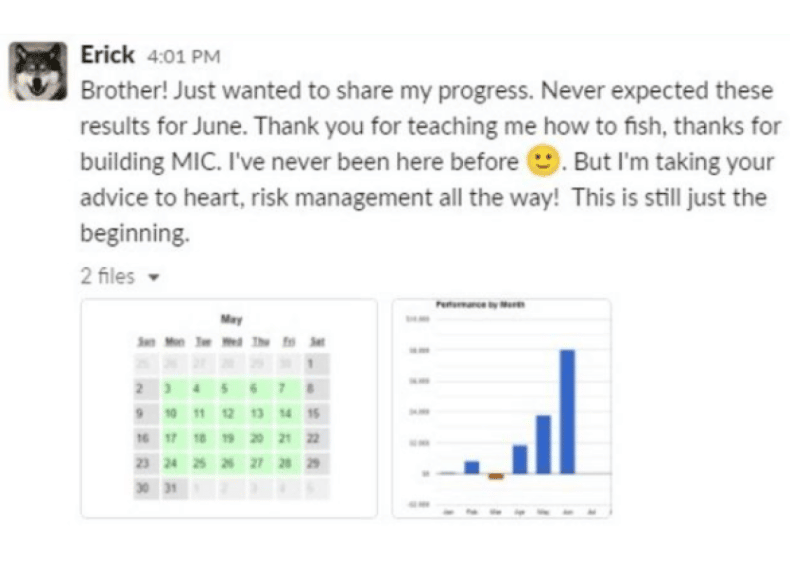

Consistency is Key

Huge profits mean nothing if you don’t know how to keep them. We teach our members how to manage their risk like professional hedge fund traders from Day 1 so their results remain consistent as they size up.

#MemberTestimonials

Here is what our members are saying!

|

Chuck J.Member Since 2020 |

|

I'm a former WT member. I was there for 3 months & lost a significant amount of money. I found Alex on instagram after I blew up and joined MIC...this place is legit.

|

James Y.Member Since 2021 |

|

I was with WT for 5yrs before I found MIC. I learned the right way to trade now through MIC. I had unlearn ALOT of the bad habits I picked up from WT and buying the breakout for 5yrs and losing.

|

Jean S.Member Since 2020 |

|

Tosh, you told me I would like this community. Best place in the planet. You guys prices are super cheap for the content.

|

Stephen J.Member Since 2019 |

|

Crazy account growth recently since I stuck to only broken back side stocks. I didn't properly understand back side shorting until I watched a huge bunch of MIC videos.

|

Nathan C.Member Since 2020 |

|

The last two months, I've learned more about real trading than I have at any time in my life!

The best broker relationship in the industry!

Are you sick of bleeding fees and commissions every month to your broker?

Successtrader offers a dedicated equity route that provides a special pass-through rebate to MIC members for adding liquidity. This special rebate can more than offset the already discounted commissions

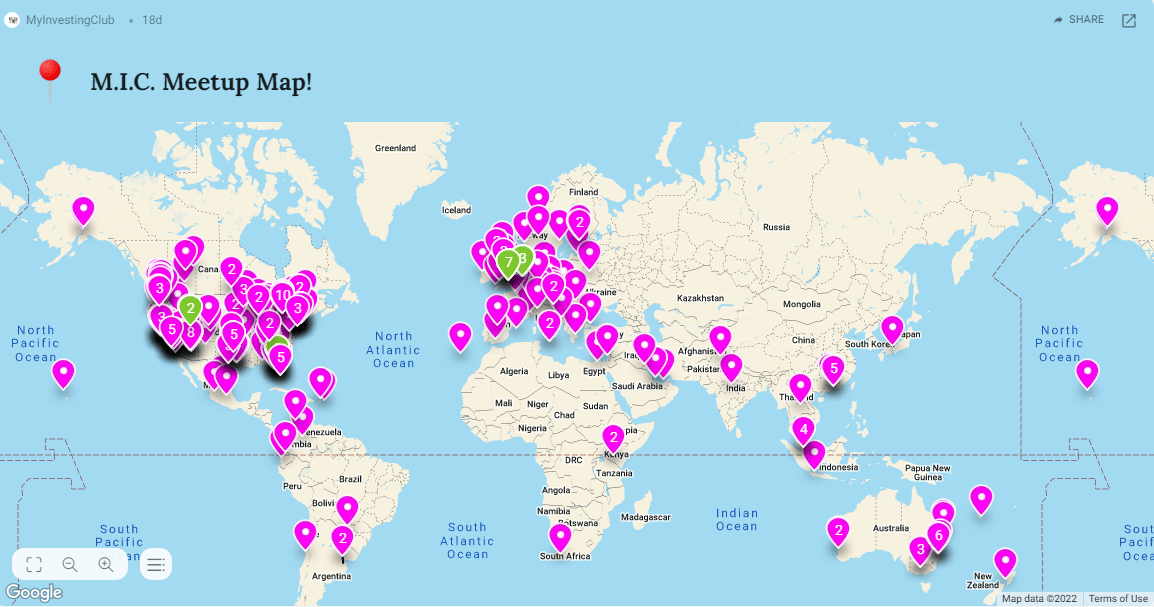

#MICMeetups