The S&P 500 Index, also known as the SPX, is a stock market index that tracks the performance of 500 large publicly traded companies listed on stock exchanges in the United States. VWAP, or Volume Weighted Average Price, is a trading indicator that calculates the average price of a security over a given period of time, taking into account the volume of trades made during that period.

Does SPX Have VWAP?

So, does the SPX have VWAP? The answer is no; the SPX itself does not have VWAP. VWAP is a technical indicator that can be calculated and applied to any security or group of securities. However, it is not a property or feature of the security itself. In other words, the SPX does not inherently have VWAP, but VWAP can be calculated and applied to the SPX as a way to analyze its price movements.

Does SPX Have Volume?

The answer is no; the SPX does not have volume, but why? Volume refers to the number of shares or contracts traded on a security over a particular period of time. Since SPX is an index, there are no shares traded. As we stated earlier, the SPX is an aggregate price that tracks the prices of the 500 companies that make it up.

Each stock in the S&P 500 Index is weighted and, therefore, can influence the price of the SPX more or less than other stocks. For example, Apple Inc. (AAPL) is weighted the most at 6.043619, meaning that AAPL stock price influences the S&P 500 Index the most. The next most weighted stock in the SPX is Microsoft Corporation (MSFT) at 5.560874, followed by Amazon Inc. (AMZN) at 2.319052 as of 01/03/2023. You can reference this site to see the weighted values for each stock in the SPX.

How Can I Get VWAP For SPX?

SPX doesn’t have VWAP because SPX itself doesn’t technically have any volume since it is an index. On the other hand, SPY, the S&P 500 ETF, has shares that trade and can be owned. So, it has volume. Since SPY has volume, VWAP can be calculated. You can reference VWAP for SPY and use it in conjunction with SPX.

Another way would be to calculate the total volume of every stock in the S&P 500 Index and then run the VWAP calculations using those volume totals and the prices. That’s if you want to hack your way into a VWAP for the SPX, but ain’t nobody got time for that.

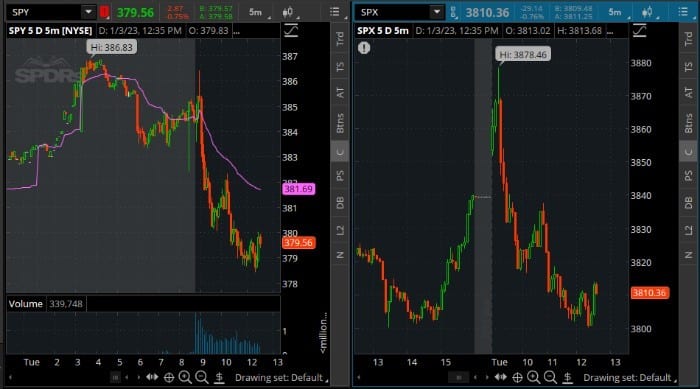

Open a separate chart for SPY and add VWAP as an indicator. Then put that chart next to SPX, and viola, you have a makeshift VWAP for SPX. It won’t be exact but don’t stress over that. It would look like this:

Is It Better to Trade SPX or SPY?

It depends on your experience level. As a beginner or intermediate trader, we suggest trading SPY options contracts. They are very liquid and low priced compared to SPX, offering more margin for error. SPX options contracts have a much higher upfront cost and require more capital to trade effectively. The spreads are also wider, leaving more margin for loss.

Experienced traders, however, may find that trading SPX options contracts can be more lucrative due to the size of the premiums involved. SPY offers lower premiums but also limited rewards when markets are volatile. Ultimately, it’s up to you and your strategy which one you choose!

Bottom Line

In summary, the SPX does not have VWAP, but VWAP can be calculated on SPY and visually applied to the SPX as a way to analyze its price movements. It is just one tool among many that traders and investors can use in their analysis and decision-making process. Don’t get caught up in the exacts. Keep your analysis and trading simple and you will have less stress and more success.