Depending on the year, the U.S. stock market averages about 252 trading days in a typical year. This is important to note as it affects the time available for executing trades and other financial activities. Additionally, certain holidays may cause markets to close down early or remain closed for an extended period, thus reducing the total number of trading days in that particular year.

For example, there will be 250 trading days in 2023. This means you will have plenty of time to monitor and make decisions in your trading portfolio and take advantage of any potential market opportunities.

Read this blog post to understand why knowing how many trading days and U.S. stock market holidays are important.

What is a trading day?

A trading day is a period during which financial markets are open for trading. Typically, trading days are Monday through Friday, with market holidays or other breaks in the middle of the week. The U.S. equities market opens at 4 AM Eastern and closes at 8 PM Eastern.

Different Types of Trading Sessions

Premarket Hours – The premarket trading session is from 4 AM to 9:30 AM Eastern. This is when most major market participants, such as investment banks and hedge funds, begin to place their trades. The volume is lighter, and the price can move drastically since most press releases and filings are released during the premarket trading session.

Regular Hours – The regular trading session is from 9:30 AM to 4 PM Eastern. This is when retail investors typically participate in the most trading activity due to the increased liquidity during this time.

Postmarket Hours (After-hours) – The postmarket trading session is from 4 PM to 8 PM Eastern, and this period allows for any last-minute trades or adjustments before markets close for the day. Much like the premarket trading session, the after-hours trading session is light volume, and the price can move drastically since press releases and filings are released during the after-hours trading session.

How many trading days are in a year for the U.S. market?

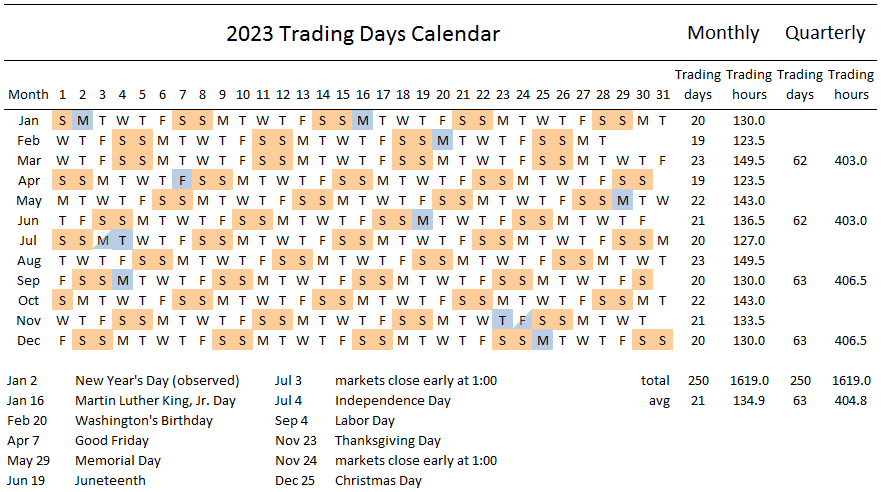

There are 250 total trading days in 2023, with an average of 21 per month and 63 for every quarter – leaving a whopping 105 weekend days when the exchanges close their doors! Plus, there are two shortened sessions to keep on your radar: July 3rd before Independence Day and November 24th after Thanksgiving Day, when the market will close at 1 PM Eastern.

Who sets the trading schedule?

The trading schedule is set by the major US stock exchanges, including the New York Stock Exchange (NYSE), Nasdaq, and the Chicago Mercantile Exchange (CME). These marketplaces work together to determine when markets will open and close annually. At a high level, they consider factors such as days of the week and holidays to ensure that there are sufficient liquidity and trading activity across all sessions. Overall, it is important to remember that the number of trading days in a year can vary depending on various market dynamics and external events.

You can keep track of all of the market holidays and trading days with these helpful calendars from swingtradesystems.com.

2023 Trading Days Calendar from swingtradesystems.com

Why does the number of trading days vary from year to year?

The number of trading days in a year can vary depending on several factors, including market holidays and special events. For example, sometimes, the markets will close early or even open late due to inclement weather or other unexpected circumstances. Additionally, some years may have more trading days than others depending on how many weekends there are or which holidays fall during that period. Ultimately, it is important to be aware of these fluctuations and make informed decisions about your trading strategy based on the current market landscape.

2023 US Stock Market Holidays

There are ten holidays for 2023 and two early closes. The holidays are as follows:

- January 2 – New Year’s Day (observed)

- January 16 – Martin Luther King, Jr. Day

- February 20 – Washington’s Birthday

- April 7 – Good Friday

- May 29 – Memorial Day

- June 19 – Juneteenth

- July 3 – Market closes early at 1:00 PM EST in observation of Independence Day

- July 4 – Independence Day

- September 4 – Labor Day

- November 23 – Thanksgiving Day

- November 24 – Market closes early at 1:00 PM EST in observation of Thanksgiving Day

- December 25 – Christmas Day

When any of the holidays fall on a weekend, the stock market will observe the holiday either on the preceding Friday or the following Monday.

Weekends

There are 105 weekend days in 2023, roughly 28% of the whole year. However, it is important to note that special events or breaking news coverage on the weekend may lead to increased volatility and volume during this period. The futures market opens on Sunday evenings at 7 PM Eastern and can indicate where the U.S. market will open on the next trading day.

Major Events

Unpredictable major market events can cause the stock market to close unexpectedly, as seen in major historical milestones such as George H.W. Bush’s death when the market closed on December 5, 2018, and the terrorist attacks of 9/11/2001, which closed the U.S. market for four days. In 2012, national disasters like Hurricane Sandy forced the market’s closure for two days.

Do you trade on all trading days?

Yes, and no. The answer depends on your trading style, and it can also depend on your tax status. Yes, I said “tax status.” Traders trying to qualify for Trader Tax Status (TTS) must have been actively buying or selling securities for at least 183 trading days a year. Whether or not you actively trade on all trading days depends largely on your goals as a trader and what kind of market environment best suits your trading style.

Some traders prefer to take an active approach and capitalize on volatile market conditions. In contrast, others are more risk-averse and may choose to sit out certain sessions during periods of high market volatility. If you plan on claiming TTS, you will need to pay close attention to the number of trading days you have bought or sold securities, among other qualifications. We recommend consulting a CPA knowledgeable in TTS like TraderTaxCPA.

Trading Style

There are three major trading styles — day trading, swing trading, and position trading (long-term investing). Let’s take a closer look at each.

Day Trading

Day trading is a type of investing strategy that involves buying and selling stocks, options, futures, currencies, or other financial instruments within the same trading day. It is often used by traders who do not have a long-term outlook on the market and seek to capitalize on short-term price fluctuations. Day traders typically use a combination of technical and fundamental analysis when making trading decisions. Technical analysis involves looking at charts of historical price movements to identify certain patterns or trends that may trigger buy or sell signals. Fundamental analysis focuses on analyzing macroeconomic data such as interest rates, economic growth indicators, employment figures, and corporate earnings releases to gauge the market’s overall health and make predictions about future prices.

Day traders also need to be aware of certain factors that can impact their daily trading strategies, such as news events and market sentiment. By being in tune with the technicals and fundamentals of their chosen security and staying up-to-date with any breaking news stories that could move prices rapidly, day traders can make quick decisions to buy or sell positions to take advantage of short-term price fluctuations in the market. Additionally, they must possess an ability to control risk through proper position sizing and understanding how much capital they are willing to risk per trade.

Swing Trading

Swing trading is a type of investing strategy that seeks to capture gains in a stock or other financial instrument over a short period, usually within two to six days or a couple of weeks. This trading style attracts investors who may not have the time or inclination to monitor day trading strategies actively. The goal of swing trading is to identify potential price swings in the market and capitalize on them by entering positions at points of support and resistance.

To be successful with swing trading, traders need to recognize a range of technical indicators such as Fibonacci retracements, pivot points, moving averages, and relative strength index (RSI). Swing traders use these indicators to identify trends and patterns in the market that may indicate an opportunity for profit. Additionally, they can gain insight into the possible entry and exit points through trend lines and support/resistance levels.

Traders need to have an understanding of market sentiment when utilizing this strategy. Swing traders need to know how market sentiment may impact their trades – will current events cause prices to rise or fall? Traders should also keep an eye out for any news announcements that could affect the stocks they are interested in buying or selling. Finally, many successful swing traders keep track of their trades using risk management techniques such as stop-loss orders and position sizing. By managing risk in this way, swing traders can maximize profits while limiting losses.

Position Trading (Long-term Investing)

Position trading is an investing strategy that involves buying and holding assets for a longer period, usually several weeks, months, or years. This type of trading is best suited for those with a long-term outlook on the market who are willing to take on more risk to reap greater rewards potentially.

Position traders look at macroeconomic factors such as interest rates, economic growth indicators, employment figures, and corporate earnings reports to gauge the market’s overall health and make predictions about future prices. By understanding these fundamental factors and having a clear view of what may happen to stock prices over an extended period, position traders can develop trading strategies that capitalize on slow but steady price movements over an extended period.

Position trading allows traders to benefit from short-term and long-term market trends by taking advantage of short-term swings in price within an established trend. Since position trades are typically held for weeks or months at a time, traders can ride out market corrections or consolidations that may occur during their trade. They can also use stop-losses or other risk management tools as part of their overall strategy.

Unlike day trading or swing trading strategies which rely on swift reactions and frequent trades based on technical indicators, position trading requires patience and discipline since profits may not be seen until after several weeks or months of holding onto stocks or other financial instruments. As such, it is important for position traders to have a good understanding of fundamentals before entering into any positions and enough capital to hold onto those positions until they reach their target profit point.

If you have been told advice like “buy good companies,” then you have been advised to be a position trader.

Vacations

Taking a vacation each year from the market is important for your mental and physical health. We need to decompress because trading is very stressful. Be careful how long you take if you are planning to claim Trader Tax Status, as I mentioned earlier. For example, if there are 250 trading days in the year, like 2023, and you have to trade at least 183 of those trading days, your vacation can’t last more than 67 trading days.

That’s roughly three months of vacation time, including weekends. This is why we can experience a “Summertime lull” in the markets. Traders are taking June, July, and August off for vacation. Therefore, volume and overall activity will be lighter. This isn’t guaranteed because we have seen some of the hottest summertime markets since 2020 that we have ever experienced. That is likely due to traders not being able to travel as freely as they could in the past. I know I am one of those that fall into that category.

Unexpected Situations

Unexpected situations in your life can lead to you needing to take additional time off from the market. We recommend taking as much time as you need to recoup fully. As we said in vacations, your physical and mental health needs to be at its peak.

Don’t trade when there are physical or mental struggles weighing you down. Let’s say you had an argument with someone close to you this morning. You can’t seem to shake the feeling you were left with. This feeling can affect your decision-making and damage you financially if you don’t make the right decisions. Loss of money on top of everything else can only magnify the frustration. Eventually, everything snowballs out of control, and you lose thousands of dollars.

Take care of yourself first. The market will always be here when you’re ready to come back.

Losing Streaks

Losing streaks can be one of the most difficult aspects of trading, both mentally and financially. It is important to remember that every trader experiences losses at some point and that it is a part of the process. Taking the time to review why a position may have failed can help traders avoid making the same mistake again and look for opportunities that may arise from their mistakes.

The first thing any trader should do when facing consistent losses is to take a step back and analyze what went wrong. A great way to do this is by reviewing all trades for patterns or possible errors in judgment. Identifying patterns or errors on an ongoing basis can help traders identify possible causes for their losing streak, such as failing to follow their trading plan, using too much leverage, or placing too many trades at once. After identifying these potential issues, it is important for traders to adjust their trading strategies accordingly and make sure they are following their trading plan to maximize profits.

Implementing sound risk management strategies can also help protect against prolonged losing streaks. Setting stop-loss orders and limiting position size are two key ways traders can ensure they aren’t risking more than they should on any single trade. Additionally, having capital reserves set aside specifically for times of market volatility can also help cushion against extended losses while allowing traders the freedom to remain in the markets during periods of extreme price fluctuations.

Finally, traders need to stay focused on their long-term goals despite suffering from a losing streak. Keeping track of successful trades instead of dwelling on the bad ones can help build confidence and keep a trader motivated during hard times. Emotional control is also key in helping you stay calm and focused during periods of market stress and turbulence so taking regular breaks throughout the day or away from trading altogether can give you time to recharge before returning with a clear head and refocused strategy.

Bottom Line

In conclusion, there are 250 trading days in 2023 with an average of 252 trading days in a year. However, it’s important to note that unexpected circumstances, such as personal issues or losing streaks, can affect the number of trading days you’re available. Traders should consider these variables to maximize profits when planning their strategies for any given year. Additionally, utilizing sound risk management strategies and staying focused on long-term goals during difficult times is key to helping ensure success in the markets over time. With proper preparation and dedication to building successful habits, along with an understanding of how different factors may affect your trades throughout the year, you’ll be well-equipped to navigate any market environment successfully!