If you’re reading this, you’ve heard the term “bear market.” But what exactly is a bear market? In short, a bear market is a prolonged period of decline in the stock market. A bear market is typically defined as a drop of 20% or more from its 52-week high. Another level that traders and investors watch to determine if the market is in a bear market or not is the 200-period simple moving average (SMA). But, there’s an even more precise definition of a bear market, and we will cover it here in A Beginner’s Guide to Bear Markets.

The MIC strategy has been a lifesaver for traders in this bear market. Watch our free 1-hour webinar to learn our strategy and turn your trading around!

The Basics

The S&P 500 Index’s highest closing price was $3,386 on February 19, 2020. 20% below $3,386 would be $2,709. The 200-period SMA was $3,037. So, we can conclude with the criteria we mentioned if the market falls below $2,709, that’s a bear market.

We all know what happened in February 2020; the COVID pandemic. The S&P 500 did just what we described above. So, was that the bear market? Not quite. There’s another critical factor—time.

The amount of time it takes for the markets to reach bearish territory is critical. The market in 2020 fell very quickly. If the markets fall quickly into bearish territory, this is called a “correction.” We have experienced many corrections since the 2008 recession but not an actual bear market.

The Slope — The Secret Sauce

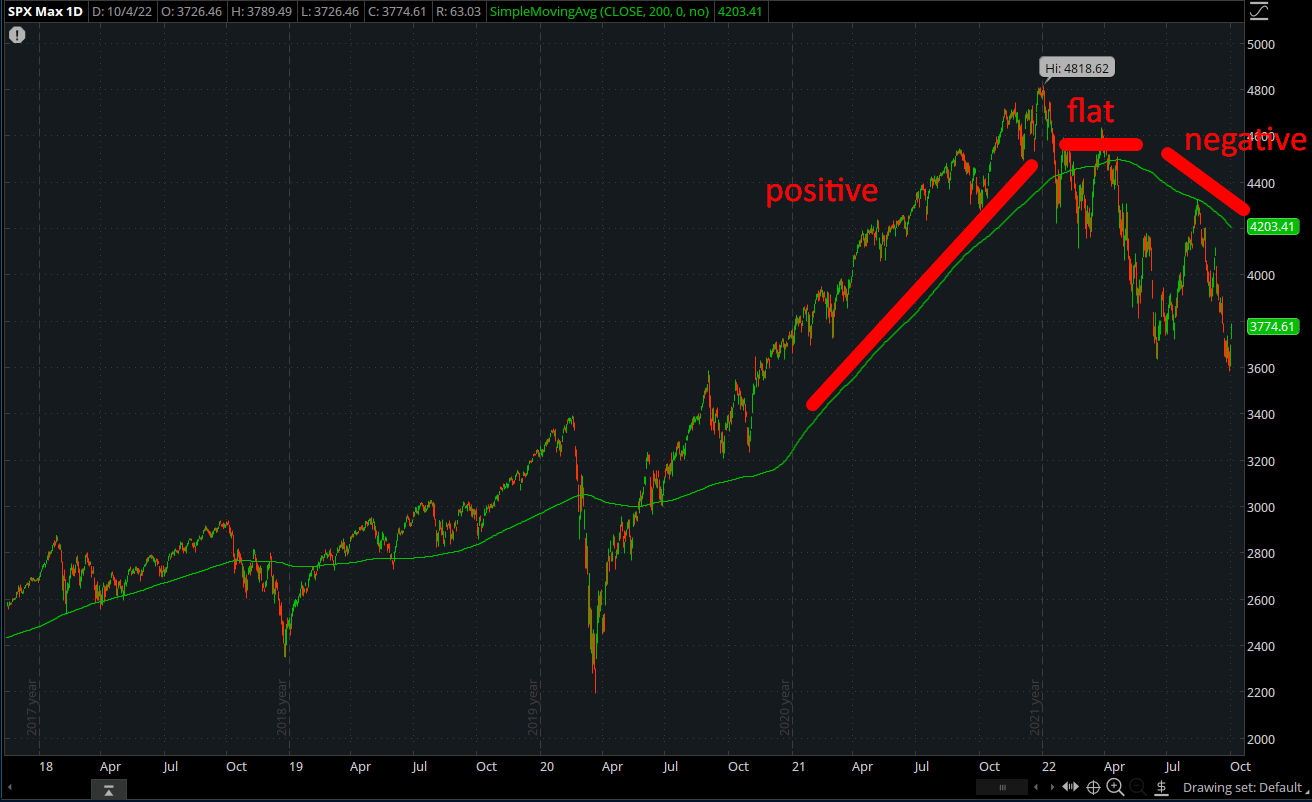

We are referring to the slope of the 200-period SMA. A positive slope looks like it is climbing uphill, and a negative slope looks like it is rolling downhill. Sounds too simple, we know, and more times than not, the secret sauce is simple.

Here is what we mean:

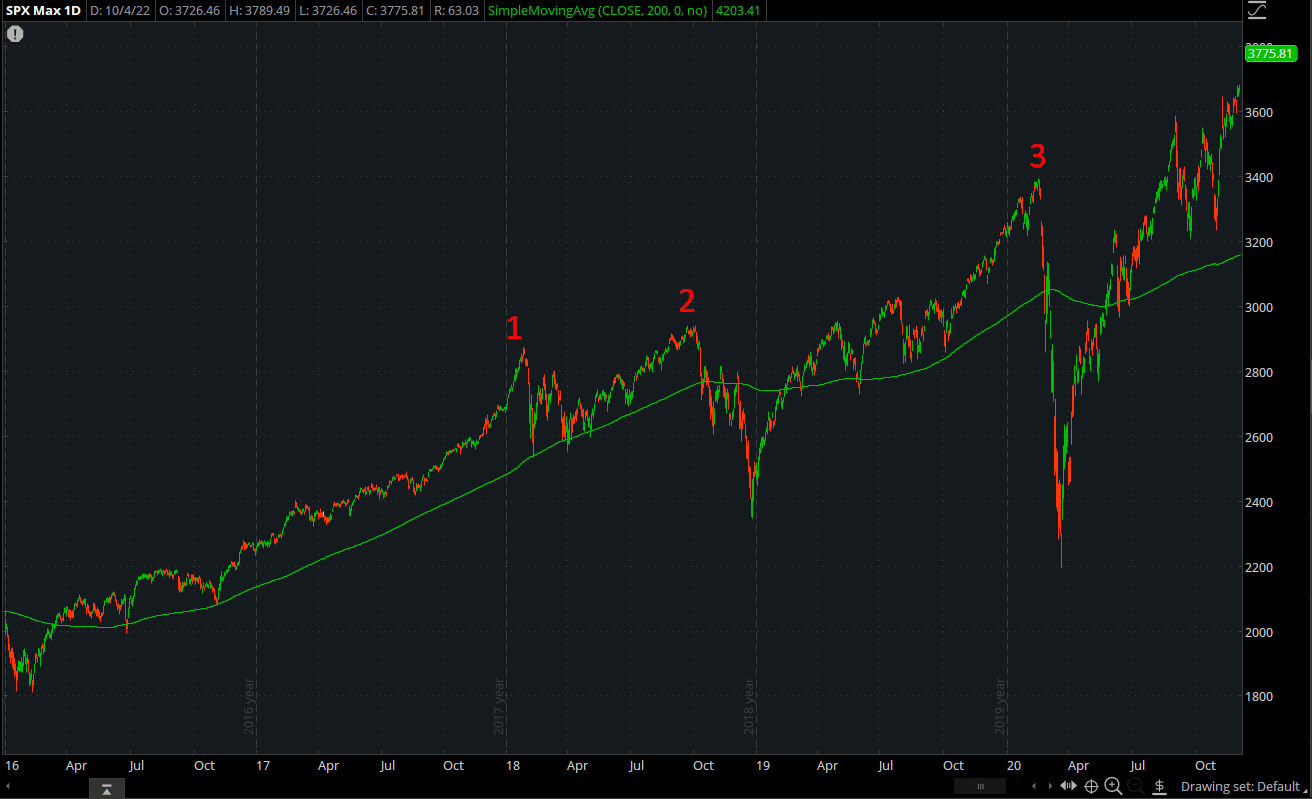

If we examine the markets during the “corrections,” you will see the 200-period SMA was positive to flat. This criterion allows us to determine when we are experiencing a market correction or a bear market.

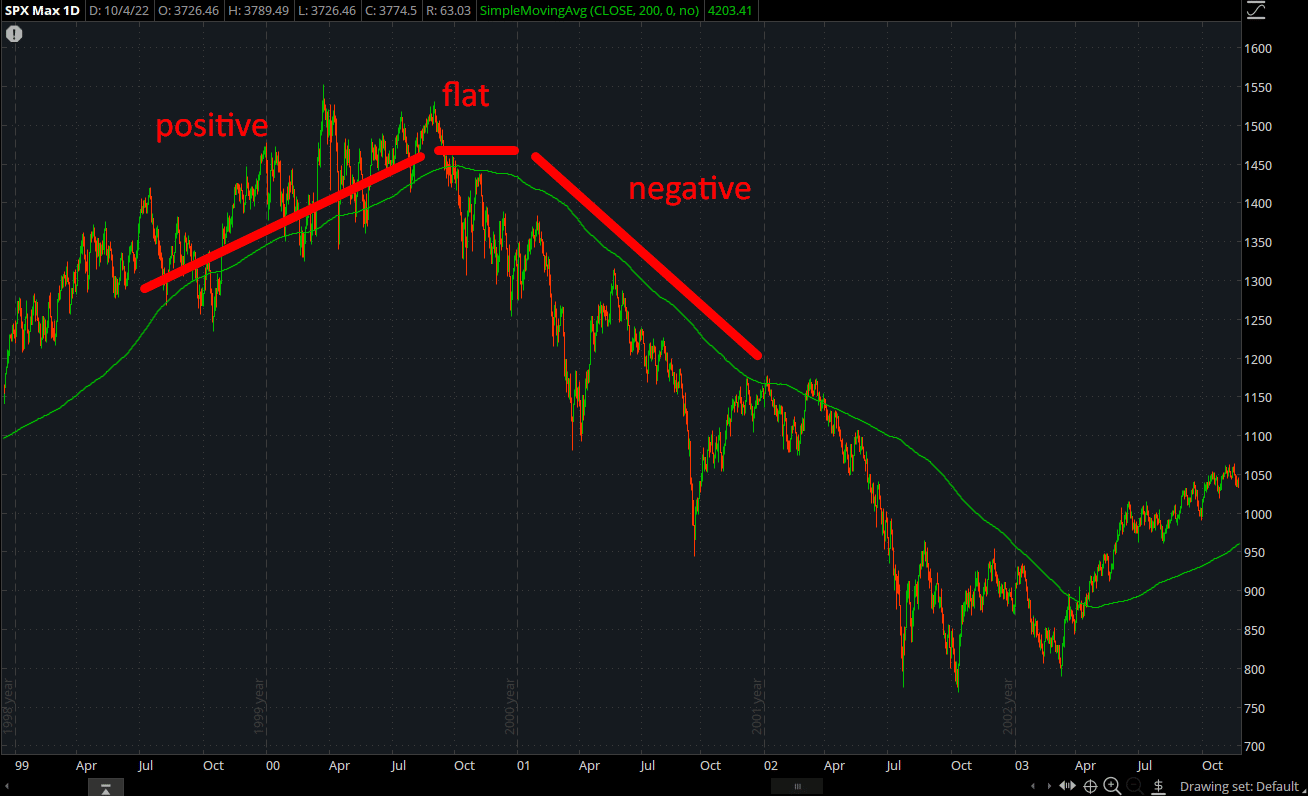

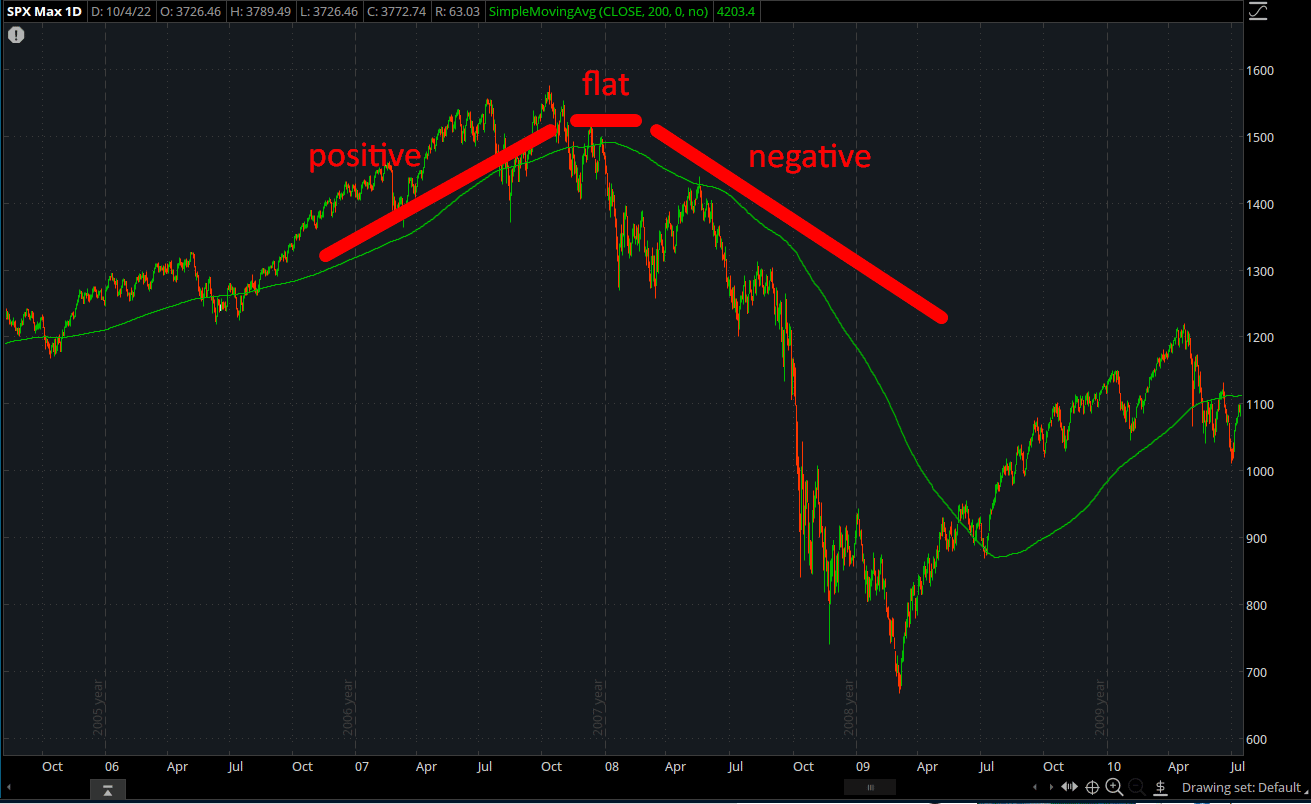

Let’s look at bear markets now. You will see once the 200-period SMA turns from a positive to flat and then to negative, we can confirm an actual bear market.

2001 Recession

2008 Recession

2022 Recession

See the slope shift from positive to negative? That’s our confirmation, our secret sauce.

Now that we know what qualifies as a bear market let’s look at some factors that can contribute to one.

Economic Downturns

One of the most common causes of bear markets is an economic downturn. When the economy weakens, businesses start to make less money. This decreased revenue often leads to layoffs and even more economic instability. As consumers become worried about their financial future, they’re less likely to spend money—further exacerbating the problem. All of these factors can quickly cause the stock market to nosedive.

Interest Rate Changes

Another factor that can play a role in bear markets is interest rate changes. When interest rates go up, it becomes more expensive for businesses to borrow money—which can lead to decreased spending and investment. At the same time, when individuals have to pay more interest on their loans, they also have less money available to spend. These circumstances often result in lower stock prices and increased market volatility.

Geopolitical Tensions

Last but not least, geopolitical tensions can also lead to bear markets. When there’s uncertainty or instability in the world, investors tend to become skittish and sell off their stocks. This selling can cause stock prices to plummet—triggering a bear market. For example, geopolitical tensions between the U.S. and China recently caused a mini-bear market in August of 2019, which was just a “correction,” as we pointed out earlier.

How to Profit From a Bear Market

1. Look for recession-proof stocks.

2. Research companies with solid balance sheets.

3. Focus on companies with high dividend yields.

4. Consider shorting overvalued stocks.

5. Stay patient and don’t panic sell.

Now that we know what causes bear markets let’s look at how you can protect your portfolio if one occurs. First and foremost, it’s important not to panic—even though that can be easier said than done. It’s also important to remember that bear markets are generally short-lived; they last about 12-18 months from the highest peak.

Bottom Line

Bear markets can be scary for beginners, but there are ways to profit from them if you know what you’re doing. Following the tips above and watching our free 1-hour webinar can drastically improve your chances of making money in a bear market. Remember to remain patient and not make rash decisions—a bear market will eventually end, and the stock market will rebound. Thanks for reading!