In my last blog, I shared my perspective of the parallels between climbing a mountain and learning to day trader. I wanted to expand on that a bit and take a deeper dive into one of the many tactical skills necessary before starting the big climb – controlling greed and FOMO.

The Merriam-Webster Dictionary defines greed as “a selfish and excessive desire for more of something than is needed (such as money)”. The attempt to possess more than one needs, sometimes at the expense of others. I was actually surprised to see that FOMO is listed in the Merriam-Webster Dictionary. There it is defined as “fear of not being included in something that others are experiencing”. This strong feeling of pressure that you put on yourself to participate in something to avoid missing it. In the image shared here, both “greed” and “FOMO” are evident in the cattle seeking more than it has on its own side of the fence for fear of missing out on something that is tastier. Greed stems from a desire for personal gain, while FOMO stems from fear. Fear of not being with or like others. While “greed” and “FOMO” are not synonymous, they both can cause individuals to make impulsive decisions which could potentially be harmful to themselves and others.

Greed is a central concept in many educational programs including theology, philosophy, history, politics, psychology, and economics. Countless college papers and dissertations have been written on the topic. In theology, greed is considered one of the seven deadly sins. Some even consider it the mother of all evils, with the remaining sins being rooted from greed. Philosopher David Hume described greed as “a double edged sword”, motivating on one hand, and destructive to society on the other. While some level of greed may be essential for things like economic development and growth, it can also have negative outcomes and cause negative behaviors such as theft, deception, and corruption.

Greed in Day Trading

Greed has been on Earth since the beginning of time, and I suspect it has been within the world of trading just as long. In day trading, “greed” also refers to our desire for more. Not being satisfied with the amount that the Market gives us and holding out for more. The problem with this mentality is that more times than not, you will give back your wins and sometimes even more. It is important to note that greed and FOMO are not the only highly emotional aspects of trading. Some others include fear, impulsivity, and irrational decision making. The mental fortitude required for day trading is tremendous.

How to Identify if You Are Being Greedy

Below is just a small list of things to consider in deciding if you are experiencing greed.

- Holding on to a losing trade, hoping it will return to be a profitable trade.

- Holding on to a winning trade, hoping for more money.

- Sizing up because you want to make more on the trade.

- Ignoring your risks, and only focusing on potential gains.

- Making a trade simply because you do not want to miss out (FOMO).

- Taking a trade without doing your due diligence.

- Taking a trade simply because you see others taking the trade.

- You turned a nice day of profits into a day of losses by over trading or trading stupid things just because you see others banking on it.

Fix Your Greedy Little Self

You and only you can fix your problem with greed. To help you reduce your tendencies toward greed and FOMO, here are a few suggestions:

- If you recognize that you are falling into a greedy-mode, walk away. Take a few minutes away from the screen to clear your mind.

- While you are clearing your mind, focus on what matters most your health and your family.

- Stop focusing on what others are doing! If this means deleting your social media accounts, then do so immediately.

- Practice mindfulness. This is typically done through meditation and requires you to think about what is happening right now, instead of what already happened or could happen.

- Life by Design – This is a phrase that Bao (Modern Rock) often refers to. Build relationships with people that you want to be like or that have the same values and goals as you.

Design Your Life as a Day Trader

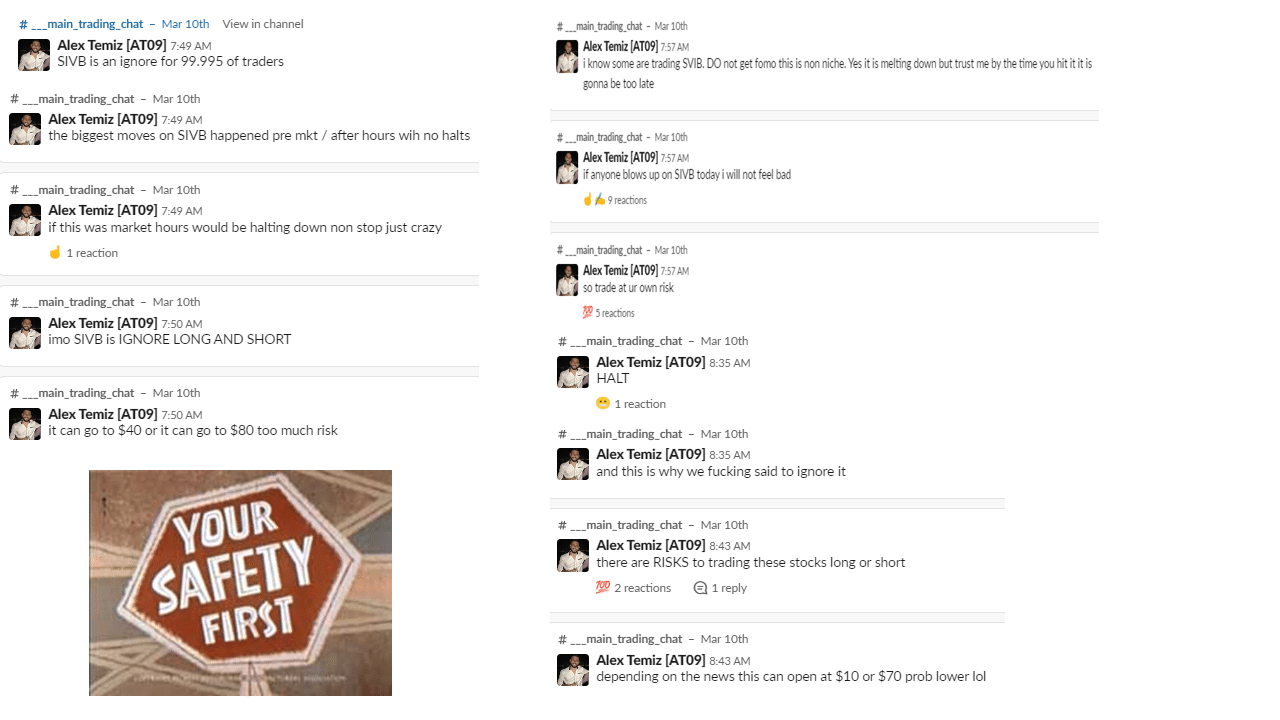

Are you ready to design your life as a day trader? Start by building relationships with like-minded individuals passionate for trading. Every day in the My Investing Club (MIC) chat room, Mentors, Moderators, and Jr. Moderators are keep the members safe. Not only are they educating every step of the way during busy times, they are also keeping us entertained during slow times, and safe during risky times. For example, on 3/10/23 when SIVB tanked from $264 to $39, Alex was constantly reminding the MIC members to look at other trades. He warned over and over again about the risks associated with such a trade. By introducing other tickers that were moving, he was able to keep members from having FOMO.

Get Started at My Investing Club (MIC)

Greed and FOMO can kill your mental, physical, and financial capital. It is essential that you learn the skills to recognize and fix them when they present their ugly little heads. Do not let greed control you. Design your life as a day trader by joining MIC.

If you are interested in joining MIC for a discount or upgrading your current membership, here is a discount link for you to use.

~girlstradetoo