Watch

The Importance of Money Flow

Understanding the concept of money flow is crucial for making informed decisions and maximizing profits. My Investing Club, a leading trading club for traders of all levels, excels at breaking down complex concepts into digestible insights. Money flow can help you indicate if a stock should be focused on the long side or the short side. Today, we delve into the fundamentals of money flow and its significance in day trading.

What is Money Flow?

Money flow refers to the net flow of funds into and out of a particular security or market. It provides traders with insights into the buying and selling pressure within a given timeframe. Positive money flow indicates more buying activity, while negative money flow suggests more selling activity. Money flow can also help if you are short biased. If you are short another stock on the day (Mostly small cap trading) while another stock has all the attention or (Money Flow), it can help give you confidence that the stock will continue lower. This is because the long biased traders are focused on the stock with the Money Flow.

Examples Of Money Flow

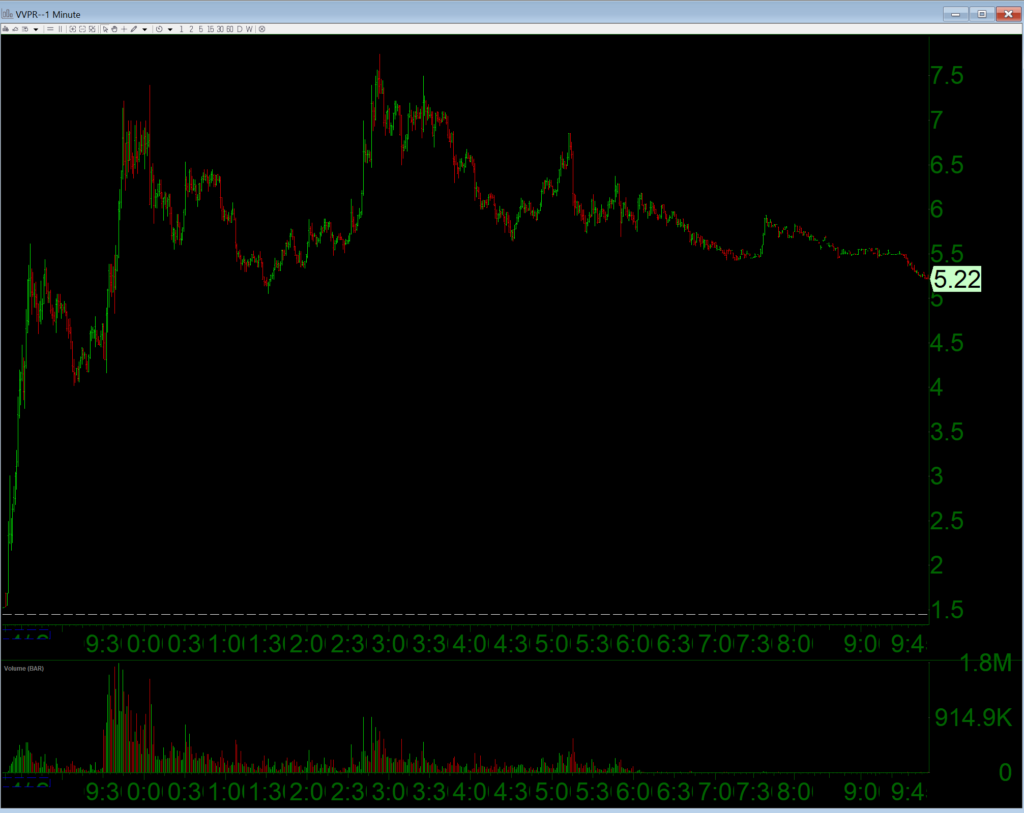

In this first picture, we have VVPR. This stock was running on news. As you can see this stock ran from $1.50 to $7.50. This is a great example of money flow. Traders were focused on this stock, pushing a lot of volume into it. Causing it to run the way it did. The stock was constantly trapping and making new highs and all attention was here.

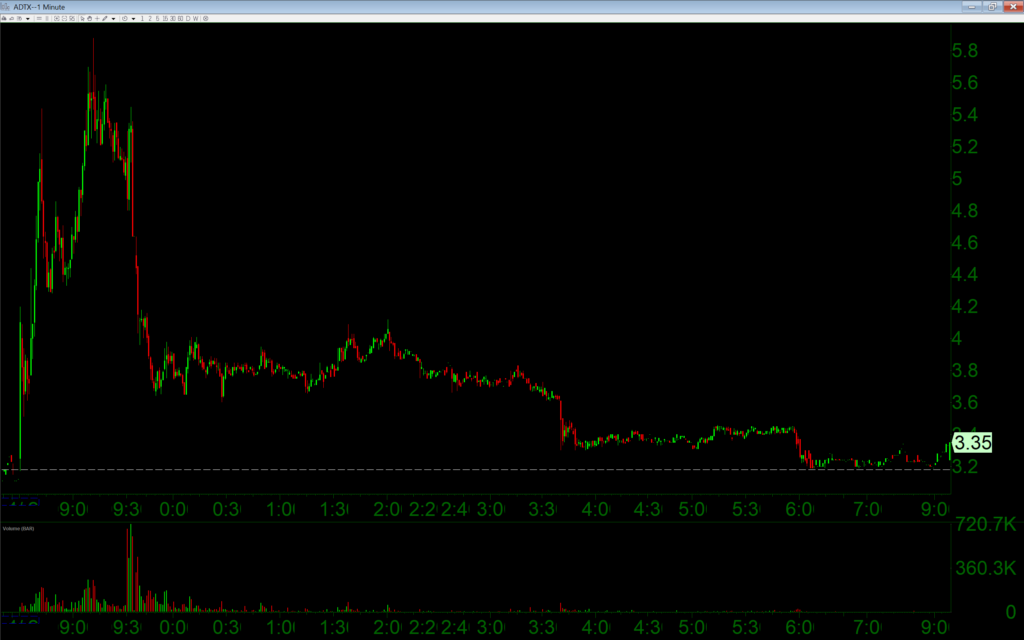

In the picture below we have ADTX. This stock was also running on news but because VVPR had much higher volume and news that the market dictated to be good. Money flowed out of ADTX and into VVPR, causing the stock to tank from $5.80 all the way down to $3.35

Importance of Money Flow in Day Trading

- Identifying Market Sentiment: By analyzing money flow, traders can gauge the sentiment of the market. Positive money flow indicates bullish sentiment, signaling potential buying opportunities, while negative money flow suggests bearish sentiment, prompting caution or potential short-selling opportunities.

- Confirming Trends: Money flow analysis can help confirm the strength of a trend. In an uptrend, increasing positive money flow confirms the bullish momentum, supporting the upward movement of prices. Conversely, decreasing positive money flow or increasing negative money flow during an uptrend may indicate weakening momentum and potential trend reversal.

- Spotting Divergences: Divergence between price action and money flow can provide valuable insights into potential trend reversals. For example, if prices are making higher highs while money flow is making lower highs (bearish divergence), it may signal weakening buying pressure and a possible trend reversal.

- Validating Trading Signals: Money flow analysis can help validate trading signals generated by other technical indicators. For instance, if a stock’s price breaks out above a resistance level with a surge in positive money flow, it adds conviction to the bullish signal generated by the breakout.

How My Investing Club Teaches Money Flow

At My Investing Club, we understand the importance of hands-on learning and practical application. Through live trading sessions, educational webinars, and comprehensive resources, we empower traders to master the art of money flow analysis.

- Live Trading Demonstrations: Our experienced mentors conduct live trading sessions, demonstrating how to analyze money flow in real-time. Traders gain practical insights into interpreting money flow data and integrating it into their trading strategies.

- Educational Content: We provide in-depth educational content covering various aspects of money flow analysis, including interpretation techniques, common pitfalls to avoid, and advanced strategies for maximizing profitability.

- Interactive Q&A Sessions: Our interactive Q&A sessions allow traders to engage directly with mentors, asking questions, seeking clarification, and deepening their understanding of money flow concepts.

- Case Studies and Examples: We supplement theoretical knowledge with real-life case studies and examples, illustrating how money flow analysis can be applied across different market conditions and trading scenarios.

How Alex Temiz Uses Money Flow For Day Trading Stocks

Alex Temiz is known for his astute approach to trading stocks, leveraging the concept of money flow to inform his decisions. His methodology revolves around analyzing the net inflow and outflow of funds within the market to identify potential trading opportunities. Here’s how Alex Temiz trades stocks using money flow:

- Identifying Strong Money Flow Stocks: Alex begins by scanning the market for stocks exhibiting strong money flow characteristics. He looks for securities with consistent positive money flow, indicating strong buying interest and potential upward momentum. A stock with negative money flow indicates a lack of buying interest signaling a possible reversal.

- Confirming Trends: Once Alex identifies candidate stocks with positive money flow, he corroborates this data with technical analysis to confirm existing trends.

- Spotting Divergences: Alex keeps an eye out for divergences between price action and money flow, which could signal potential trend reversals. For example, if a stock’s price is rising while money flow is declining (bearish divergence), he may consider scaling back or exiting his long position or switching to a short biased trade.

- Using Money Flow as a Confirmation Tool: Money flow serves as a confirmation tool for Alex’s trading signals generated by other technical indicators or fundamental analysis. A surge in positive money flow following a breakout or bullish signal adds validity to his trading thesis. Or if Alex is short a stock while another stock has the Money Flow, it adds into his confidence that the stock may continue lower. As a short biased trader, you want to see that the stock you are short does not obtain the money flow. Which can help continue the bearish trend.

- Continuous Learning and Adaptation: Alex understands that markets are dynamic and subject to change. He continuously educates himself on evolving market trends, refines his money flow analysis techniques, and adapts his trading strategy accordingly to stay ahead of the curve. By integrating money flow analysis into his trading methodology, Alex Temiz navigates the complexities of the stock market with precision and confidence, unlocking opportunities for consistent profitability.

Conclusion

Money flow analysis is a powerful tool in a day trader’s arsenal, offering valuable insights into market sentiment, trend strength, and trading opportunities. By mastering the fundamentals of money flow with the guidance of My Investing Club, traders can elevate their skills and achieve greater success in the dynamic world of day trading. Join us on the journey to financial mastery and unlock the potential of money flow analysis today!