In a captivating live day trading session, Alex Temiz unveils his strategy that netted him $5,000 using a simple yet effective VWAP (Volume Weighted Average Price) methodology. Focusing on overlooked stocks, Alex navigates through the complexities of the market with an edge that many traders aspire to master. This article dives into the nuances of his strategy, punctuated with moments from the video where visual aids underscore the pivotal points of his trading journey.

The VWAP and Money Flow Strategy

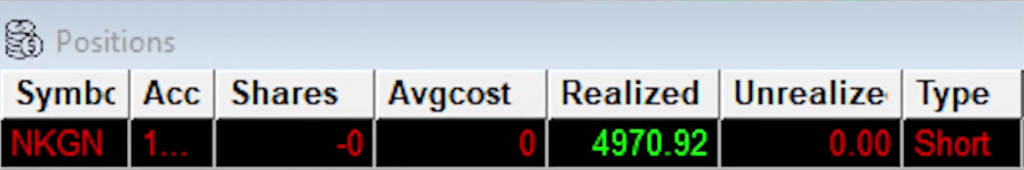

Alex begins his session with a clear intent: to target largely ignored stocks, those “that people forgot about, and the stocks that have the most edge.” He quickly identifies a potential trade with NKGN, an example of such a stock, setting the stage for a $5,000 profit.

As the session progresses, Alex closely monitors NKGN, noticing a bounce that piques his interest. Despite an initial “big fail” at the VWAP, he sees an opportunity for a bounce short, demonstrating the importance of adaptability in trading strategies.

With precision, Alex starts building his position in NKGN, emphasizing small size due to the less-than-ideal entry point. His commentary reveals a layered strategy that balances risk with the potential for profit, all while keeping an eye on other stocks like CELZ and LYT for money flow indicators.

As NKGN approaches his ideal price level, Alex adds to his position, drawing on technical analysis and market sentiment to guide his decisions. His focus remains split between NKGN and the broader market dynamics, showcasing a multi-faceted approach to trading.

In a decisive move, Alex capitalizes on a “death candle” in NKGN, increasing his position size. His anticipation of market reactions to money flow from LYT and CELZ highlights his strategic foresight.

As the trade unfolds, Alex’s patience and strategic positioning begin to pay off. He meticulously manages his position, ready to adjust based on market movements and the performance of related stocks.

The Culmination

The climax of Alex’s trading session arrives as he begins to cover his positions, securing profits from the meticulously executed strategy. His approach to scalping—a technique focused on small, quick profits—demonstrates his skill in selecting and capitalizing on the right opportunities.

Alex’s final move to cover more of his position near the VWAP area, ready for another entry if the opportunity arises, encapsulates the dynamic nature of day trading. His ability to remain flexible, adapting to the market’s ebbs and flows, underlines the session’s success.

Reflections on a Successful Trade

As Alex wraps up his trading day with a significant profit, his reflections offer valuable insights into the mindset of a successful trader. He emphasizes the importance of focusing on overlooked stocks and maintaining an edge through strategic selection and execution.

This session with Alex Temiz not only showcases a successful VWAP strategy in action but also serves as an educational journey through the intricacies of day trading. Through strategic foresight, meticulous execution, and an adaptive approach, Alex navigates the market with expertise, securing a notable profit and providing a blueprint for aspiring traders.