A watch list is a key tool for all traders, and you can more easily identify trading opportunities as they arise by tracking specific stocks. This article will discuss how to create a watch list and offer tips to help you get the most out of this important tool.

The Process of Creating a Stock Watch List

First, determine what your watch list criteria will be. Are you looking for specific industries or market caps? Will you prioritize stocks with high volume or recent news events? Once you have established your watch list guidelines, it’s time to start searching for potential stocks to add.

Many traders use websites or software to track their watch lists. These options offer added features, including viewing real-time stock quotes and setting alerts for when specific watch list stocks reach the desired price. However, you can create a watch list by keeping a spreadsheet or physical notebook with your chosen stocks.

You can create a watch list by using a stock screener. A stock screener is a tool that allows you to filter stocks according to specific criteria that you choose. For example, you may want to screen for stocks with a specific price range or those in an industry you are interested. Using a stock screener, you can quickly narrow the list of potential stocks to watch.

Stock Screeners

A stock screener is a tool traders use to filter stocks that meet specific criteria. Stock screeners can be helpful when looking for stocks to add to your watch list. Many different stock screeners are available, each with its own set of filters.

Some common filters include:

- Price: The stock must meet a certain price threshold

- Volume: The stock must have a certain amount of volume traded each day

- Industry: The stock must belong to a certain industry

- Market Cap: The stock must have a certain market capitalization

There are several stock screeners available online where you can input these criteria, and here are some of the most popular ones:

Thinkorswim by TD Ameritrade (Our #1 Recommendation)

Free

Almost every broker has a built-in screener inside their trading platform these days. The most advanced, free option (we love the free ones) is Thinkorswim by TD Ameritrade. Thinkorswim is very popular with our mentors, moderators, and members. This platform provides the best charting and stock screening to create a watch list from any other platform or screener on the market. Use Thinkorswim. You won’t regret it.

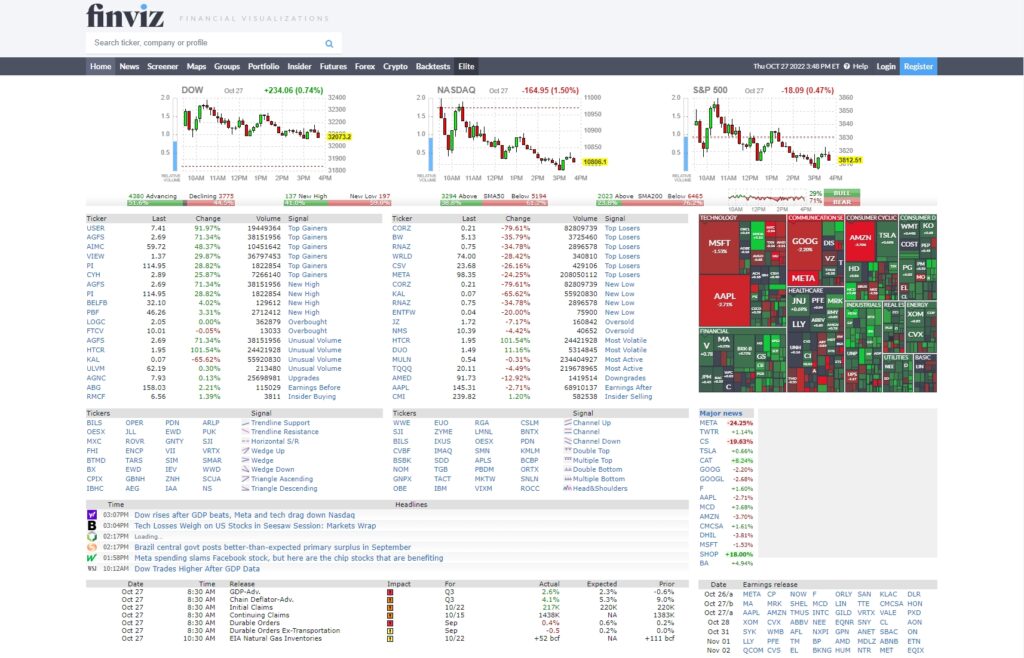

FINVIZ

Free and paid options, starting at $24.96/mo

FINVIZ is a web-based screener that offers a wide range of filters, including price, volume, industry, and market cap. It also includes a heatmap that displays how a particular stock performs relative to the rest of the market. And the best part is it’s free. You’re going to be ridiculed with ads, though. So, the paid version is very affordable to hide all that nonsense.

Other Worthy Mentions

Trade Ideas

Paid, starting at $84/mo

Trade Ideas is a paid stock screener. It offers a variety of filters, including technical indicators and price breakouts. It also includes a watch list feature that allows you to track stocks that meet your specific criteria. The downside is that it is not free like FINVIZ or your broker platform. Prices start at $84/month.

StocksToTrade

Seven-day trial for $7, and Paid, starting at $179.95/mo

StocksToTrade offers more comprehensive and sophisticated filters than FINVIZ and Trade Ideas. In addition to the standard filters, such as price and volume, StocksToTrade offers advanced charting, technical indicators, and an algorithm called Oracle. It also includes a watch list feature that allows you to track stocks that meet your specific criteria. The same downfall applies here; it is not free like FINVIZ or your broker platform.

Filters and Criteria to Create a Stock Watch List

There are many other possible filters, depending on what you are looking for in a stock. Finding a screener that meets your needs and offers the features you are looking for is important.

Our favorite criteria are used to find the top percent gainers like this:

- Price greater than $1 and less than $10. Our sweet spot is that $1-$5 range.

- Volume during pre-market of at least 100K. After the market has closed, we increase that to 1M.

- Percentage gain greater than 20%. Percentage gain means how much it is up on the day. We only want to see stocks with momentum, which is a great way to filter out the noise.

A Popular Downfall of New Day Traders

A common mistake many new day traders make is spending money on all these tools instead of education. They feel these tools will be the secret to their success, and the truth is they won’t. Not one of our mentors and moderators uses a paid screener. We teach our students to keep their costs down as day traders.

Day trading is a business, and you must treat it like one. If your business is not profitable, unnecessary expenses like screeners can bleed you dry and shut you down for good. The same goes if you are profitable. A quick way to increase your bottom line is by trimming the fat.

Once you have identified potential watch list stocks, research the stocks on your watch list further to make sure they meet your initial criteria and fit within your strategy. If you don’t have a day trading strategy, check out this free 1-hour webinar where we teach you our favorite day trading strategies. It’s important to regularly review and update your watch list, removing any stocks that no longer align with your watch list guidelines or trading goals.

Tips for Utilizing Your Watch List

Now that you have established a watch list, it’s time to put it into action. Here are some tips for making the most out of your watch list:

- Set price alerts to trigger when the stock

- Monitor the stocks on your watch list regularly, especially during market volatility or when a stock triggers an alert.

- Use your watch list to plan trades, but don’t feel obligated to trade every stock. Instead, wait for favorable conditions and profitable opportunities before making a move.

- Consider diversifying your watch list with stocks from various industries and market caps instead of just focusing on one specific type of stock. Diversifying can help mitigate risk in case certain industries or markets are underperforming.

- Keep track of important dates, such as earnings releases and dividend payments, for the stocks on your watch list to stay informed and potentially take advantage of any resulting price movements.

What a Good Watch List Looks Like

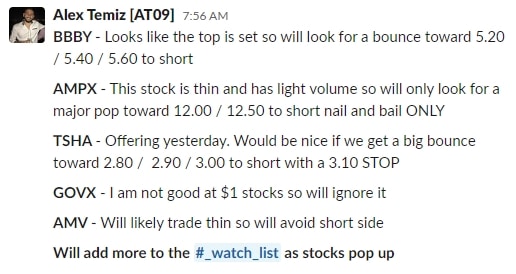

Alex Temiz, a head mentor of My Investing Club and millionaire day trader, provides members of the club with his complete watch list every morning. This watch list can be used as a model for creating your own. It includes stocks that meet his criteria, such as price and volume, as well as percentage gain. The stocks on Alex’s watch list are also screened using advanced charting and technical indicators.

Here is what Alex’s watch list looks like:

What’s Next

Now that you know how to create a stock watch list, the best way to succeed as a day trader is by having an excellent mentor to educate you on right and wrong. My Investing Club provides the best mentors for students. Plus, our mentors create a stock watch list for members with a complete trading plan each morning for our members. Check out this free 1-hour webinar today to get started learning our strategies.

Creating and utilizing a watch list is crucial for successful day trading. Following these steps and tips, you can simplify the watch list process and trade like a pro. Happy hunting!