Trading is risky, and you can lose money in the blink of an eye if you’re not careful. That’s why paper trading is such an essential tool for traders. Paper trading is a simulation of actual trading, where you trade with “fake” money instead of using your hard-earned cash.

Why paper trade? Because it’s the best way to test your strategies without putting your own money at risk. You can make all the mistakes you want and learn from them without losing a dime. In fact, many trading firms require their traders to paper trade for a certain period before they start trading with real money. We recommend all of our member’s paper trade until they prove they are profitable with fake money.

How to Paper Trade

Paper trading is simple. All you need is a brokerage account and some “play” money. Many brokerages will give you a designated amount of fake money to start paper trading.

Once you have your paper trading account, you can start creating trades. Remember that since this is fake money, you don’t have to worry about following rules or regulations (within reason). So if you want to buy 10,000 shares of a penny stock, go for it! Of course, you would never do that in the real world because it’s too risky. But in the world of paper trading, anything goes.

The Pros and Cons of Paper Trading

Like everything else in life, paper trading has its pros and cons. Let’s start with the pros:

- You can test out any strategy without risking your own capital.

- You can make mistakes and learn from them without losing any money.

- You can get comfortable with the mechanics of placing trades before risking your own money.

Now let’s look at the cons:

- Paper trading can give you a false sense of confidence because there’s no real money at stake.

- You might become too comfortable making risky trades when there’s no downside to doing so.

Despite the cons, we still think that paper trading is a valuable tool for traders—especially new traders who are still learning the ropes. Just be sure to keep the above points in mind. At the same time you’re paper trading, remember there’s no substitute for real-world experience!

Bottom Line

Paper trading is a great way to learn about trading without risking your own capital. You can test out any strategy you want and make mistakes without consequences. Just remember that paper trading has its downsides and can give you a false sense of confidence. So, be sure to use it as just one part of your overall education as a trader.

What’s Next?

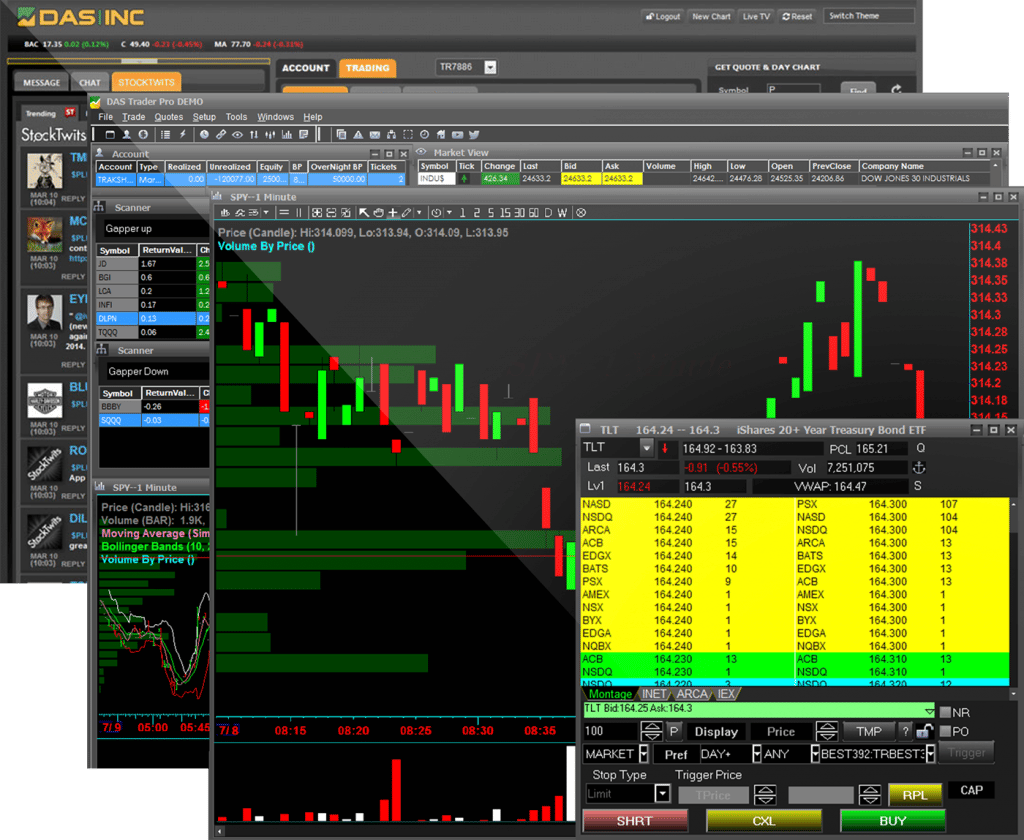

Start practicing! Need somewhere to do it? Get free 14-day access to the DAS Trader Pro Trading Simulator here.

Thanks for reading!