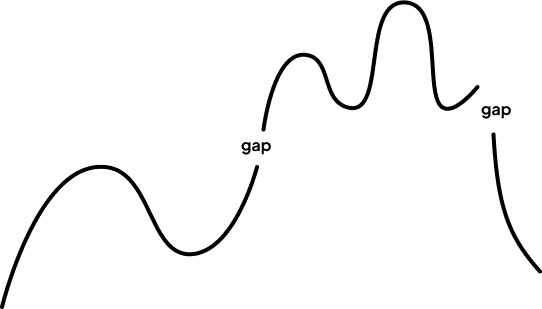

Experienced day traders know that stocks don’t always move in a straight line. It’s not uncommon for stocks to “gap” up or down at the market open or close. But what does it mean when stocks are gapping up or down? Let’s take a closer look.

What Is a Gap?

In the most basic sense, a gap is simply a break in price action. When you see a stock “gap up,” the stock opened at a higher price than it closed on the previous day. Conversely, when you see a stock “gap down,” the stock opened at a lower price than it closed on the previous day. Stocks gapping up or down can occur at any time during the trading day, but they’re most common at the open and close.

Why Do Stocks Gap Up or Down?

There are several reasons why stocks might gap up or down. One of the most common reasons is earnings announcements. If a company reports better-than-expected earnings, you’ll typically see the stock gap up on enhanced demand. Likewise, if a company misses earnings estimates, you’ll often see the stock gap down on increased selling pressure.

Other common reasons for gaps include things like analyst upgrades/downgrades, FDA approvals/denials, merger news, etc. Generally, any news that surprises investors can lead to a gap.

What Does It Mean for Traders?

For day traders, gaps can present both opportunities and challenges. On the one hand, gaps provide an easy way to enter (or exit) a trade. For example, if you see a stock gap up on solid earnings, you might buy shares, assuming that the momentum will continue. Conversely, if you see a stock gap down on weak earnings, you might short-sell shares betting that the selloff will continue.

The challenge with trading gaps is that they can be difficult to predict and even harder to time correctly. Just because a stock gaps up doesn’t mean it will continue higher throughout the day (and vice versa). This is why many day traders avoid chasing gaps altogether; it’s simply too hard to predict which way they’ll go next.

Bottom Line

Gapping up and down is just part of trading life—something all investors need to be aware of. Although gaps can create trading opportunities, they can also be difficult to predict and time correctly. As such, many day traders choose to sit on the sidelines when stocks are gapping rather than try to pick which way they’ll go next.

What’s Next

Want to learn more about trading? Click the link to join us in our next free 1-hour webinar, where we will discuss our favorite strategies and how we trade them!