Hey there, fellow traders! Are you tired of losing money in the day trading game? Have you been struggling to find that elusive “edge” that successful traders seem to possess? Well, fear not! In this post, we’ll share tips and tricks from expert day traders to help you find that edge and start making profits.

What is Edge?

Before we dive in, let’s quickly define what we mean by “edge.” In the world of day trading, an edge refers to any advantage a trader has over the market. This advantage could come from various sources, such as superior knowledge of a particular industry, a more advanced trading strategy, or access to better tools and technology. An edge can make all the difference in day trading, allowing you to make more informed decisions and increase your chances of success.

Example of Edge in a Trade

Let’s say that a day trader has identified a particular stock symbol that they believe has an edge. They’ve spent time researching the company and its industry and have identified some key factors that they believe will drive the stock price higher in the near term.

The trader places a buy order for the stock at a price they believe is undervalued. Over the next few hours, the stock price begins to climb as more traders recognized the same value that the trader saw. As the stock price reaches a level that the trader believes is overvalued, they place a sell order and lock in their profits.

In this example, the trader’s edge comes from their in-depth knowledge of the stock and its industry. By recognizing the stock’s undervaluation, the trader could buy at a discount and sell at a higher price, generating a profit. This is just one example of how having an edge can make all the difference in day trading.

Another Example of Edge

Let’s say that a day trader is interested in trading a particular stock and has conducted a technical analysis of the stock’s price chart. They identify a resistance level at $50 and a support level at $45. Based on this analysis, the trader decides that if the stock breaks through the resistance level of $50, there is potential for a bullish trend to develop, with a target price of $56. However, if the stock falls below the support level of $45, the trader believes that a bearish trend could emerge, with a target price of $40.

The trader decides to place a buy order for the stock at $50, with a stop loss at $47. This provides a 2:1 risk-to-reward ratio, as the trader is risking $3 per share (the difference between the entry price and the stop loss price) to potentially gain $6 per share (the difference between the target price and the entry price). The trader is confident in this strategy, as they have identified support and resistance levels that have held in the past and believe they will hold again in the future.

If the stock price rises as anticipated and hits the target price of $56, the trader will make a profit of $6 per share. However, if the stock price falls and hits the stop loss at $47, the trader will only lose $3 per share. Using a 2:1 risk-to-reward ratio based on support and resistance levels, the trader can gain an edge by identifying a potentially profitable trading opportunity while limiting risk.

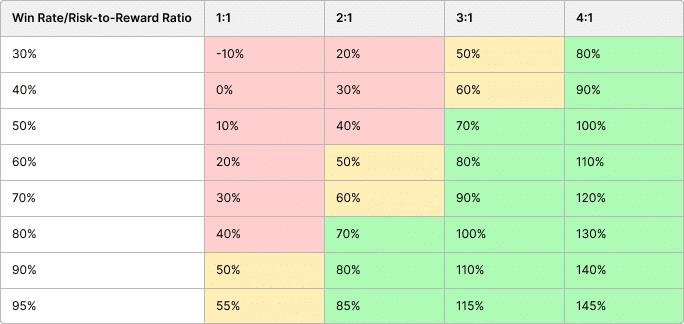

As you can see, the higher the win rate, the more likely a trader will be profitable. For example, a trader with a win rate of 95% and a risk-to-reward ratio of 4:1 is likely to be profitable 145% of the time. However, it’s important to note that achieving a win rate of 95% is extremely difficult, and most traders are likely to have a win rate that falls somewhere between 50% and 70%.

This table also highlights the importance of having a high risk-to-reward ratio. By focusing on trades that offer a higher potential reward than risk, traders can increase their profitability even if they have a lower win rate. For example, a trader with a win rate of 50% and a risk-to-reward ratio of 3:1 is likely to be profitable 70% of the time. This emphasizes the importance of having a solid trading strategy that maximizes profitability while minimizing risk.

Tips for Finding an Edge

So, without further ado, here are some tips for finding an edge in day trading:

- Learn a proven profitable trading strategy: One of the best ways to gain an edge in day trading is to learn a proven profitable trading strategy. This can involve studying the strategies of successful traders, attending trading courses, or seeking a mentor. By learning from those who have already achieved success in the markets, you can avoid making costly mistakes and increase your chances of success.

- Develop a solid trading plan: A trading plan is a set of rules you follow when making trading decisions. A good trading plan should outline your entry and exit points, risk management strategies, and overall goals. By having a solid trading plan in place, you can avoid making impulsive decisions and stick to a disciplined approach to trading. This can give you an edge over traders who lack a clear plan and are more prone to emotional decision-making.

- Use technical analysis: Technical analysis is a method of evaluating securities by analyzing statistics generated by market activity, such as past prices and volume. By using technical analysis, you can identify trends and patterns in the market that can help you make more informed trading decisions. Various technical analysis tools are available, such as moving averages and candlestick charts, that can be used to identify potential trading opportunities.

- Decide what setup(s) make the most sense to you and practice them using a paper trading account: Being comfortable and confident in the concept of the setup(s) you are trading or learning is crucial to success. If the setup(s) don’t make sense to you, you will likely never be profitable trying to replicate it independently. A great way to practice the setup(s) is in a risk-free environment like a paper trading account before risking real money. A paper trading account can be a valuable tool for this purpose, as it allows you to simulate real trades using virtual funds.

- Specialize in a particular market or industry: One way to gain an edge in day trading is to specialize in a particular market or industry. By focusing on one area, you can develop a deep understanding of the factors that influence that market and use that knowledge to your advantage. For example, suppose you’re interested in tech stocks. In that case, you could spend time researching the latest innovations and trends in the industry, giving you an edge over less informed traders.

- Stay up to date with market news and events: One of the keys to finding an edge in day trading is staying informed about the latest news and events that could impact the markets. By keeping a close eye on financial news outlets and social media, you can identify potential trading opportunities and make more informed decisions. For example, suppose a major company announces a new product launch. In that case, that could signal buying stock in that company before the market reacts.

- Learn from your mistakes: Finally, it’s important to remember that day trading is a learning process, and everyone makes mistakes from time to time. The key is to learn from those mistakes and use that knowledge to improve your trading strategy. Keep a journal of your trades and review it regularly to identify areas for improvement. By constantly refining your approach, you can increase your chances of success and gain an edge over other traders.

So there you have it, folks – some tips for finding an edge in day trading. Remember, the key to success in day trading is discipline, patience, and a willingness to learn and adapt. With these tips in mind, you’ll be well on your way to becoming a profitable day trader. Good luck, and happy trading!