Are you interested in the fast-paced world of day trading? Before diving into this high-risk and potentially high-reward strategy, it’s essential to understand the basics. In this article, we will explain to beginners the basics of day trading.

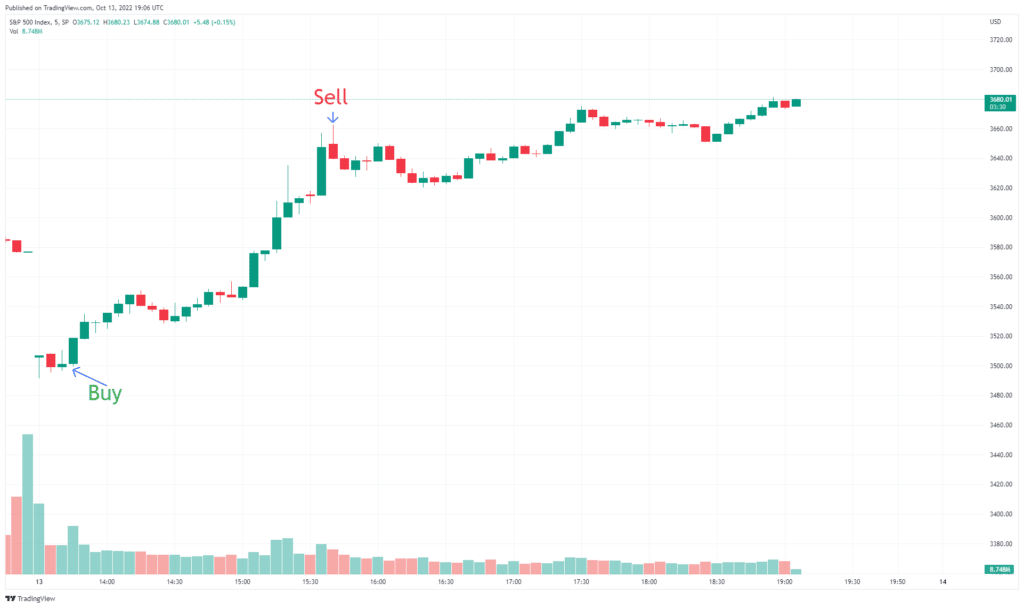

First, day trading involves buying and selling securities within a single day. For example, if a trader bought $SPX in the morning and sold that same day in the afternoon, that would be considered a day trade, as shown below.

Understanding what is considered a “day trade” is essential since you will be affected by the Pattern Day Trader (PDT) Rule.

The Pattern Day Trader (PDT) Rule

The pattern day trader rule is a regulation by the United States Securities and Exchange Commission (SEC) that imposes special restrictions on margin accounts of traders who make four or more day trades within five consecutive business days. The rule defines a pattern day trader as any trader who buys and sells the same security on the same day or buys securities and then sells them later on the same day.

The SEC enacted this rule to protect investors from excessive risks associated with aggressive trading strategies. Day traders who violate the pattern day trader rule may be subject to disciplinary action, including fines, suspensions, and even revocation of their trading privileges.

Usually, the only thing that happens is your broker locks your account and allows you to only make closing trades for positions you have already. You will be forced to wait for the suspension to be lifted off your account after 90 days or withdraw your funds and open a new account at another broker.

Day Trading Toolbox

Day traders often use technical analysis and even utilize leverage to boost potential returns. But with great profit potential also comes the potential for loss. Day trading can be risky, and educating yourself before diving in is essential.

One way to test your trading strategies without risking real money is through paper trading, where simulated trades are made in a fake account. This allows beginners to try out strategies and see how they perform before risking your actual capital.

We recommend that our member’s paper trade the strategies we teach until they prove they are consistently profitable with the paper money first. This could take several weeks or months to feel comfortable “going live,” as we say.

You can access a 14-day free trial of the DAS Trader Pro paper trading simulator here.

A solid trading plan is also essential, including strategies for managing risk and defining your entry and exit points. Day trading can be exciting, but do your research and carefully consider the potential risks before starting.

Happy trading!