In this blog post, I will write about how I personally create a watchlist for long biased traders in the small-cap space. Although it is one of the hardest things to do because of the level of accuracy and prediction required, it can be done by using the following tips to help form good and disciplined habits.

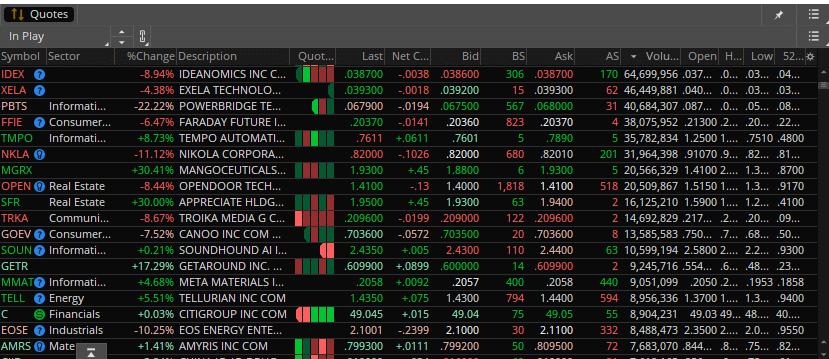

First, I always look at the top percentage gainers with good volume. As I write this in 2023, good volume means anything over 5 million shares traded. After making a list of the top stocks in play, I start to get more detailed in how I look to attack what is in play.

Once I have my list of tickers in play, even before looking at levels and things like that, I like to gauge what the market sentiment has been like over the past week or so. Has the stock market been running like crazy? Has the market been slow? Are people complaining, or are they excited? This gives me some perspective on what I can expect to get out of the market, and I consider this a huge edge.

Look at Top Percentage Gainers with Good Volume

Checking the float and dilution in the ticker is also essential for me. Getting some basic idea of the agenda has always helped give me a little bit of conviction. You need to know what to expect once the market opens. Is this ticker up a few hundred percent after filing a new ATM, or has it had some new active dilution? That is something I want to know. I may not even trade that ticker because of the recent dilution information I have found. But that is just one piece of the puzzle, and at the end of the day, you are not in control of what happens. You can only use the information available at the time to make an informed decision. Float is also something that can tell you what to expect in terms of volatility, how thin or thick the stock will be, and how much size you can use on the ticker. For someone newer, the easiest way I can describe float is an example I use quite frequently in weekend mentoring. A low float can be pictured like a smart car. These things can turn quickly and move fast. A higher float can be pictured like a transport truck. It moves a little slower and doesn’t have the mobility to turn like the smart car. Something that is thin (low float) would be like sticking your hand in water. Something that is thick would be like sticking your hand in peanut butter. The peanut butter takes a bit more force (Demand/Volume) than the water. Anyway, I am getting off track, but I want to make sure you understand.

Gauge Market Sentiment and Check Float and Dilution

After gauging the sentiment and checking the fundamentals of the ticker, I start eliminating things that I don’t like and know will not be potential plays for me. Usually, those are the tickers that are extremely above vwap. I have always found that tickers that have already gone sky-high, up a hundred or two hundred percent, have never worked for me. By the time the market opens, I find they either fade for the rest of the day, or I am forced to chase, and they do not give me the best risk-reward to enter. People in chat may call this “the hot stock,” and they are right, but I personally don’t enjoy the huge amount of risk that comes with the little reward.

Eliminate Extremely Above VWAP Tickers and Find Potentially Hot Tickers

Now is the time for me to start finding tickers that I think can be potentially hot. My criteria for this is pretty basic but advanced enough to keep myself from doing stupid things. My longing strategy has always been about finding things that trap. Since I started longing, that has been what I have tried to do. By basic definition, a trap is defined as ‘a situation in which people lie in wait to make a surprise attack.’ Each morning, I live and die by this definition, and this is how I have been making my watchlists for years. I always start with this simple question when looking at tickers: Has this stock made a surprise attack before? Has this stock squeezed out shorts already? Are shorts afraid of this ticker? Those three questions have kept me safe each morning. I have always found that, at most, a stock can trap 1-2 times, and rarely do they keep trapping. It does happen, but usually only on outlier tickers, and I have never based my daily process on things that happen once or twice every few months. If the ticker has trapped, I will eliminate it from my watchlist. If shorts are going to be scared and trade other tickers, why wouldn’t I? After all, the goal is to squeeze them, isn’t it?

These next parts of the blog post will be the hardest for some people to understand, and I know that. Don’t be afraid to read and reread these parts that come next again.

Look for Levels to Play off of and Draw Main Lines and Support Levels under VWAP

After we have further narrowed down what stocks are the ones that have not trapped yet, I am now looking for levels to play off of. This doesn’t mean that these levels are going to be the ones I use at the open. I just want to get familiar and comfortable with what I am working with. I am usually looking at support levels under VWAP. The goal here is looking at the main levels everyone is looking at. If you are using levels no one cares about, why should you? Draw the main lines and support levels under VWAP and leave them be.

Wait for Money to Flow into Target Stocks that have Not Trapped Shorts Before

Now we are all ready for the open. We have checked the float, dilution, analyzed the best tickers to look at, and have drawn our lines. What we do next all comes down to money flow and is in the market’s hands. My main strategy here is to wait for the money to flow out of the main stock running and flow into one of my stocks that I have been stalking, waiting for a trap. The ideal situation is that we get a massive stuff move or death candle on the hot stock, and I am able to scoop up some shares of one of the less popular tickers at the time. This is a hard concept to teach because it takes a lot of practice to wait during this money flow transition process. I like to focus on less popular tickers where I think longs have been stopped out a bit but not enough where the stock is dead and has completely tanked under the death line. Alive enough to get back to highs but has stopped out some people who have jumped ship to go to the hot stock. Another really good sign is when a stock has bounced off the lower part of the range and started grinding higher. That is an easy way for shorts to get caught.

For my sell targets, I focus on three main areas: the high of the day, a small area above VWAP, and a recent daily level above the high of the day. These are the points where market conditions come into play the most. In a weak cycle, I look at the area above VWAP or the high of the day. In a stronger cycle or a multi-day runner, we can usually reach the previous high on the daily chart.

I hope this blog post can help you further in your trading journey and provide you with a better understanding of how I approach long positions on these tickers. If you have any questions, please feel free to let me know.

Best regards,

Harry Hoss