What’s up, everyone? Alex here. This was a $145,000 profit in just one day of trading the meme stock, $BBBY.

People always ask me for “live trades, live trades, live trades.” I’m happy to announce that we’ll start showing more live trades. We’re going to start this one off with a bang.

TLDW (too long, didn’t watch)

Alex executes a series of trades throughout the day on $BBBY, making profits on each one. He begins shorting $BBBY when it starts to dip and covers his position for a loss as it bounces back up. Alex then uses the bounce to short again but at a higher price, scaling up his position as the stock rises. The stock later collapses, and he ends up taking profits at $14.10 for a total of $145,000.

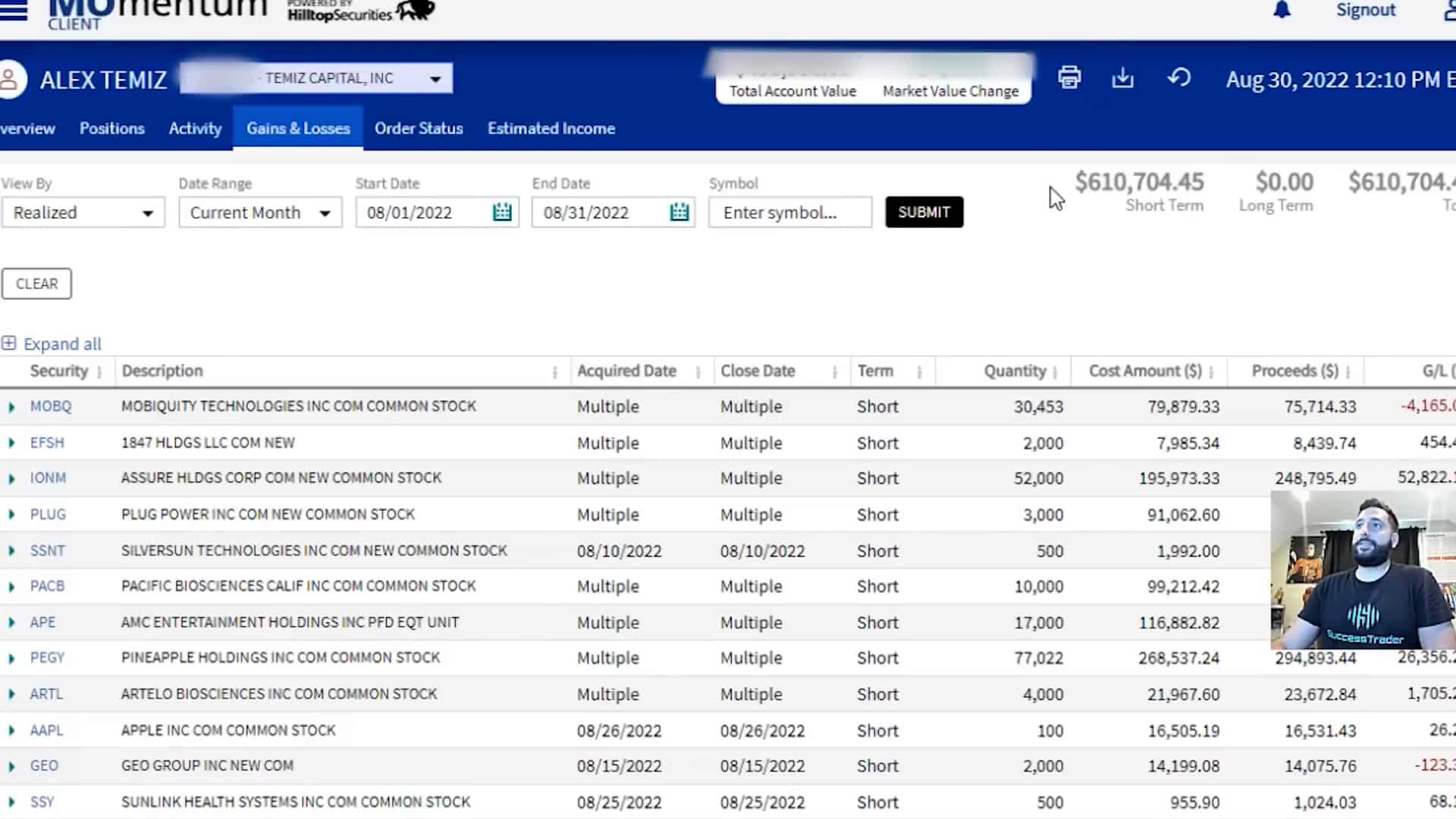

Broker Statement Proof

So before I start, I’m going to log into my broker statement to show you how I’m doing for the year. The broker I use is Success Trader, and the clearing firm they use is Hilltop Securities.

This is my broker statement. It’s not a screenshot, and it’s about a $600,000 profit this month.

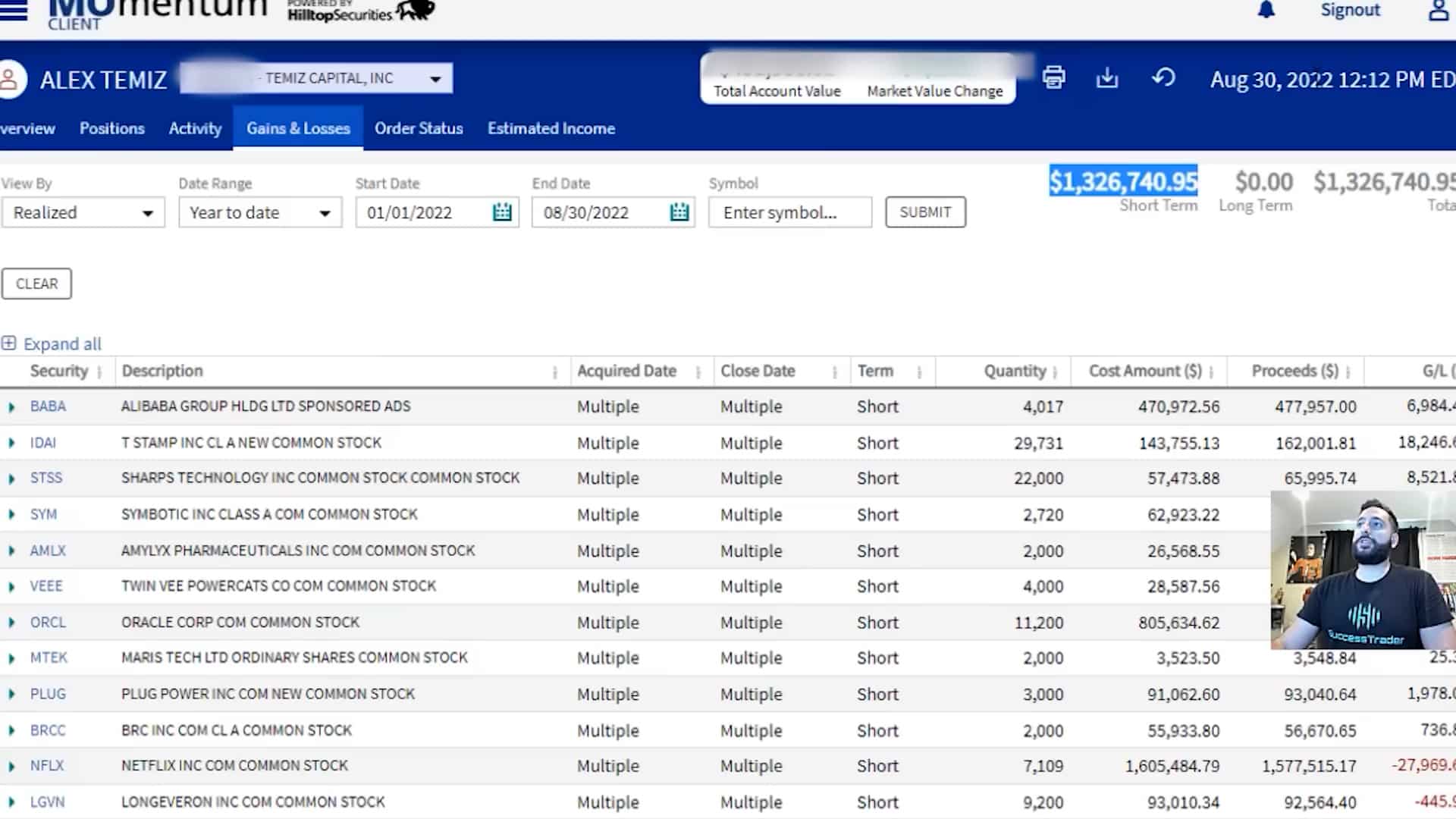

You can see about $1.3 million as of August 30th, 2022. And this does not include the $145,000 trade, and it’s closer to about $1.5 million this year in a bear market.

The Setup Details

Before I begin, let me explain the setup I will be trading here on $BBBY.

You can see from the chart that it had its first initial run-up.

This was running up on Ryan Cohen buying the stock, and the dump happened when Ryan Cohen, the CFO, and all these insiders sold the stock.

Rumors were going around that the company was going to go bankrupt. What ended up happening is that $BBBY released a press release(PR) of a forward-looking event that said, “we have some way to avoid bankruptcy.”

To summarize:

-

- Already made its parabolic move

- The stock runs up in anticipation of this PR

- Three-day run, up almost 50 percent in three days

I think long traders are stuck and looking for some exit. I’m looking for this gap to be rejected because I think everyone thinks that the “sell-the-news” setup will happen tomorrow. Since everyone thinks it will happen tomorrow, the smart money will exit the stock today into the volume and the gap. So my thesis is that the sell-the-news setup will happen one day earlier because everyone expects it to happen tomorrow. After you have a thesis, you must back it up with price action.

This is a stock that I want to get very aggressive on because it has a lot of volume. So I could trade in and out of hundreds of thousands of shares in minutes or seconds if I wanted. Such an opportunity like this doesn’t come around too often. This is a sell-the-news setup, the second-best setup I trade, and I caught the entire thing live on camera.

So let’s go through it step by step.

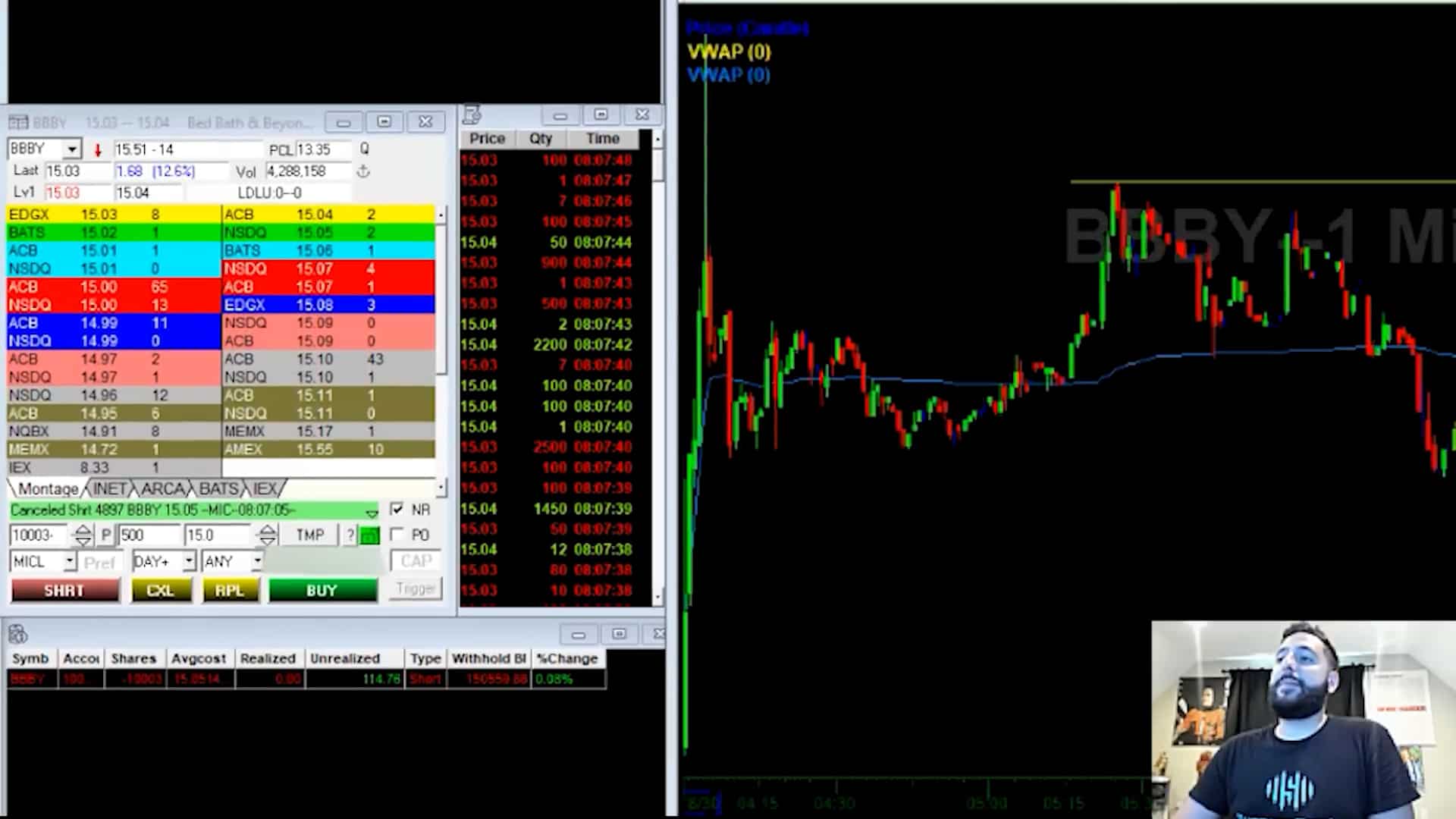

Starter Position

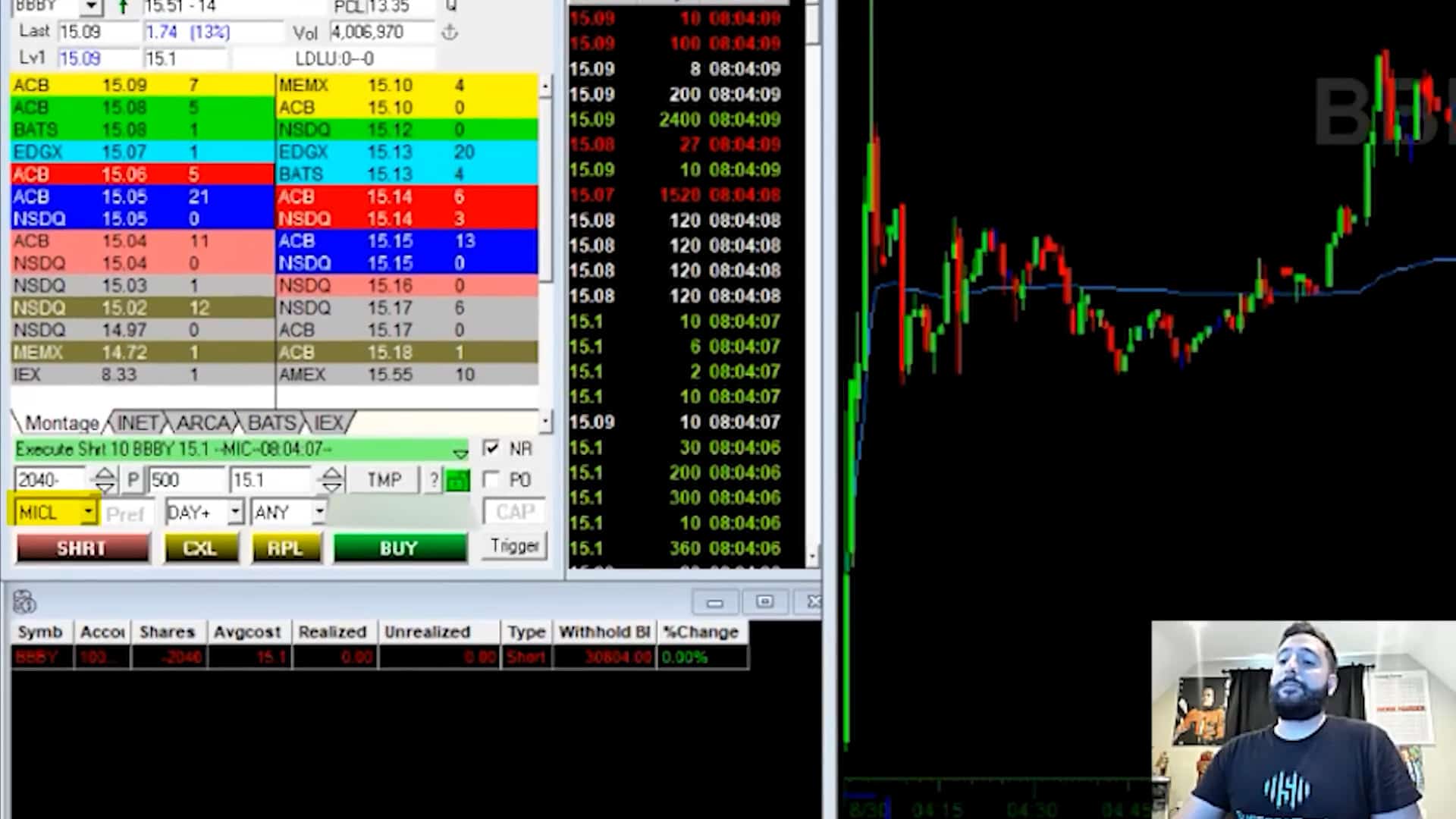

I took a small starter position on the stock at 8:04AM EST. And if you notice here, the route is MIC.

Broker

The commission structure for the broker I use, Success Trader, is .002 a share. You get a rebate of .0025 a share by using the MIC route. So if you subtract that from your commission, you get paid +.0005 per share you trade by using the MIC route. So essentially, you’re getting to trade for free plus money on top of that. This is exclusive to Success Trader clients only.

Open an account here.

Pre-market

I see the stock bouncing pre-market.

What this stock likes to do is it wants to bounce pre-market. Then, at the open, it likes to sell off. It likes to get people excited that think the stock will run pre-market, but after trading it for many days and weeks, I’ve learned its personality. I know this stock is going to try to do a pre-market run. If it fails, I’m going to get aggressive on the stock. I will get very aggressive because the stock tends to wash out at the open. The stock tends to tank at the open. And that tank is a trap to go up. And depending on how that trap acts, we’ll see what happens. I want to see the stock hold resistance at $15.20 and start to wash out under $15.

Set Risk

If the stock breaks above $15.20, I want to cover a part of my position for a small loss. If it breaks, it could quickly go to $16 or $17. and if it ends up breaking this $14.90, $15, and VWAP level, I want to get aggressive on this trade.

Adding More

I’m adding a bit to my position as $15.20 is topping out.

Drawing Lines

I’m drawing my support lines. I know that if this stock breaks under $14.55, no more support will be left on the stock until $14. so I want to give myself a visual representation of what the stock is doing.

I am zooming out to the previous days to see how much room this stock has to go down. So, as of now, I know that $14 is a pretty solid level. So that’s my target on this stock. If it goes under $14, great, but my target is around $14 for a stress-free trade on this stock.

Adding to Position

As the stock begins to go in my favor, I get a little bit more aggressive with it, keeping in mind that if this stock breaks above $15.20, I have to cover a piece of my position in case things go wrong. If it’s a small loss, I can make it back, but I’m dead if it’s a big loss.

VWAP Test

Now, the first test of VWAP here looks like it was held. So I want to be cautious, and I want to see what it is going to do next.

Stopping Out

So the stock looks like it’s about to reclaim $15.20.

I want to take a piece of my position off on a dip in case things go wrong. So rather than buying the resistance and covering right at the top, I want to let it test come back down, use that dip to stop out, and then reassess my position. So let’s see what happens here.

If you notice, the pre-market high of the day is $15.50. That is my complete emergency exit. If $15.50 breaks, I gotta e-brake out of there. They might push it above pre-market highs to get everyone excited, force shorts to exit, get the longs to buy, and then bring it back down.

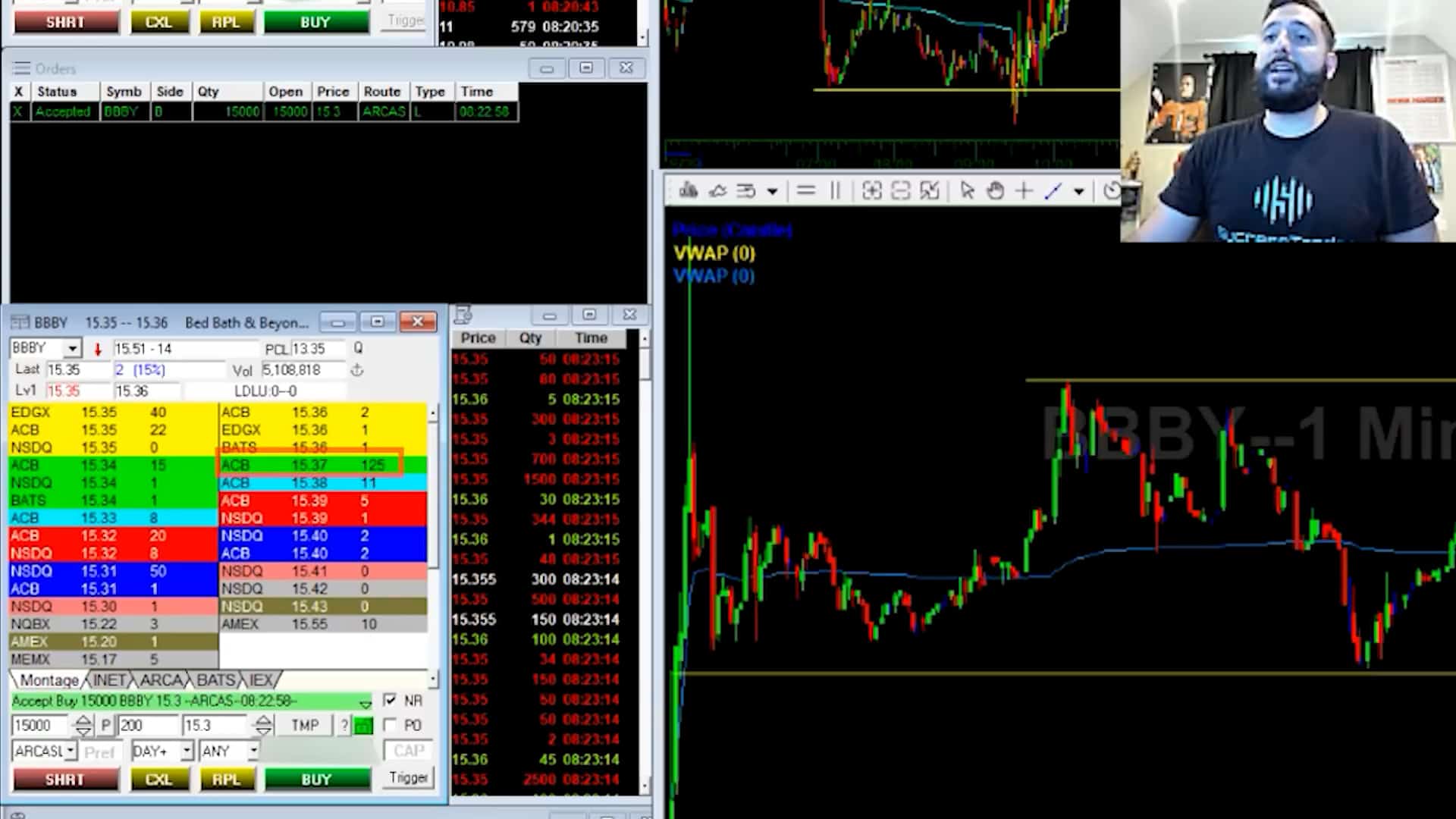

Seller Shows Up

So a seller showed up at $15.37 right there, 12,000 shares. I want to see more sellers coming into these pops and selling into them. When I saw that seller come in, I adjusted my order to cover a little bit lower. Now I’m okay covering for a small loss in case the trade goes wrong and adding it right back once it goes in my favor.

I don’t want to see this thing break $15.50 pre-market because if it does, it’s going to $16. So I am trying to mitigate my losses, and I am trying to manage my risk here just in case things go wrong. It is totally okay if I have a small controlled loss, and what I want to avoid is a loss that starts to balloon.

So now you see a big buyer here at $15.30, some selling at $15.33. so who’s going to win? It looks like the sellers won.

Partial Stop

I covered a part of my position at $15.26, and I am trying to cover some more on the dip. I have no problem adding back short if this just drops and tanks. And if this pops and pushes, I have no problem exiting my position.

Failed Bounce

I see that it’s trying to bounce. I draw my line of $15.50 and give myself a clear area to exit if I’m wrong. What I want to see here is I want to see this bounce fail, and I want to see this thing break $15.20, and if it does that, I’m going to add right back everything that I covered because, at that point, it is now a failed bounce.

Uh, oh! Now it’s starting to come back down. Now I want to add right back.

Re-Attack

$15.20 broke, and now it’s returning to be a seller, so I’m adding right back again. So whatever I exited, maybe even more than that, I want to get back in, and I want to see the same thing as before, a $15 and $14.90 break. When that happens, I will get aggressive on the stock and I have no problem hitting the bid.

It just failed that bounce. This bounce, if correct, should have gone to $15.50 and $16. Instead, some sellers showed up on this, and because they’re sellers showing up on it, that gives me confidence. I’m seeing a big buyer at $15.06 that I might have to hit myself, and I don’t care. So, I added more.

Recap

This entire move is about to be given back. So this gives me confidence. This tells me that this stock has sellers; my thesis is correct. I am okay with sizing in because my thesis is correct.

Remember, a break of $15 and $14.90 was my goal, and I want to see it break support of $14.90 and $15, so I can feel confident and get aggressive.

In a flash, we’re at $14.90.

So my thesis was correct to be shorting and adding when $14.90 and $15 broke. The market faked people out, thinking, “all right, it’s gonna go higher.” So I took a small loss and started aggressively adding back as my thesis was being proved again.

50,000 share bidder $14.88. Often if you want to bid that much, you don’t show your size because someone like me will jump you. So that might be to prop it up.

Boom! They hit him. Now I’m getting aggressive again because the trend is broken, and this thing might break $14.50 pre-market.

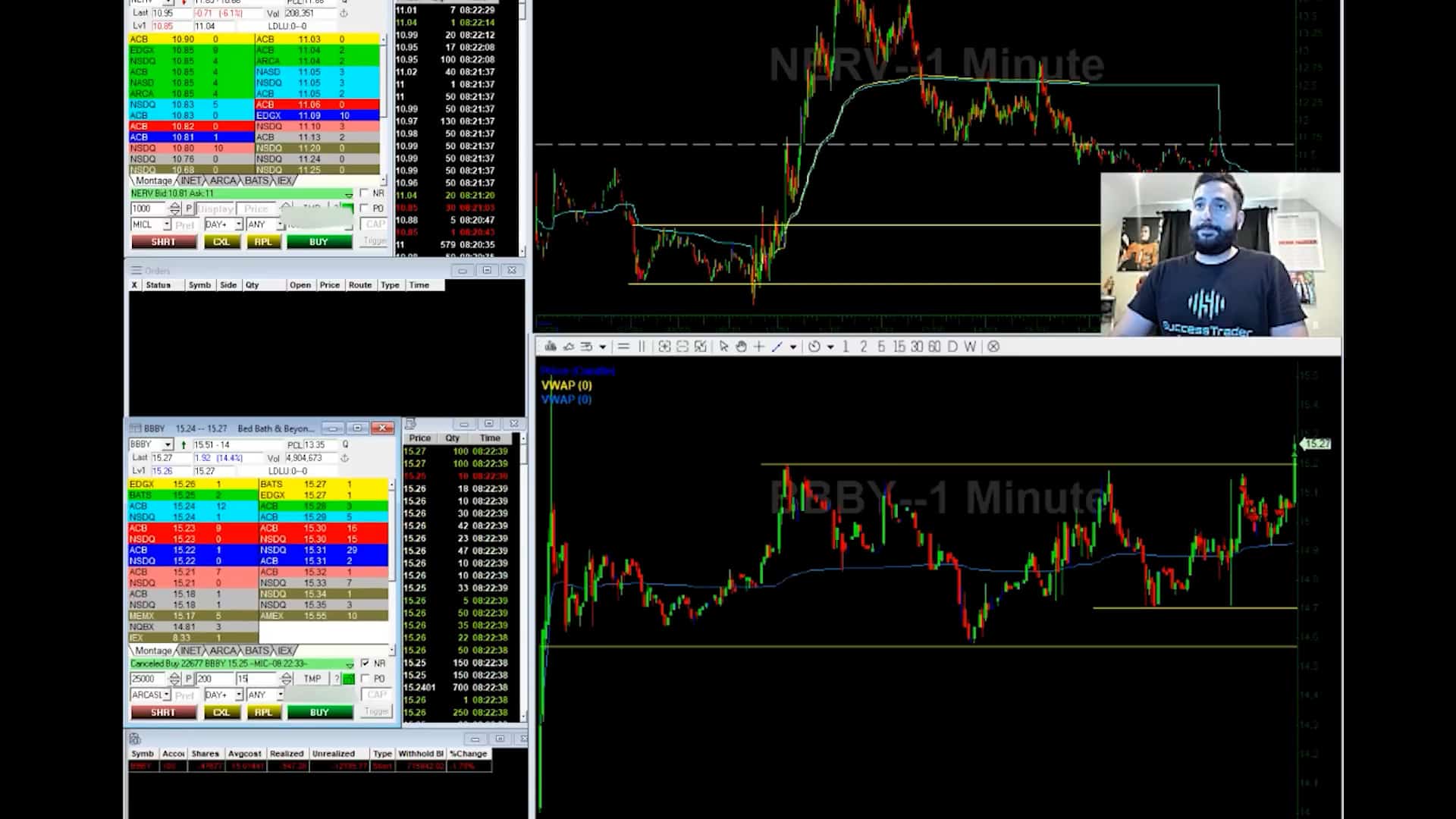

Failed VWAP Bounce Confirmation

What I want to see now is a failure at VWAP. I want to see a test, $14.95, $15, and fail. If it keeps testing and keeps failing, I will keep adding. So the more times it fails, the more aggressive I get. If it breaks above $15, I will use that same $15.20 line to stop out. I will keep adding if it stays under and cannot reclaim $15.

The bounce failed. So now this gives me confidence. I see $14.70 support, and I see $14.50 support. If $14.70 and $14.50 breaks, this thing will melt down.

Lower High, Lower High, and Fail

So what I see here is “lower high, lower high, lower high, and fail.” This is the exact thing I want to see when trading a stock like this.

Right now, I’m in 130,000 shares and up about $45,000. I’m not trying to trade to make $45,000. It sounds crazy, but this trade could be a six-figure winner. So I want to be able to lock in profits on dips and recycle those back on pops. Keep in mind this is before the market opens. So there are still 30 minutes until the market opens. A lot can change. Remember, $14.50 was a major support. So it only makes sense that it would hover around $14.50 for a little bit.

It tries to bounce, and now I want to see this bounce fails. I don’t want to see it go above $15. and as the stock breaks $14.50, I want to be able to lock in profits. I want to be able to take some off to give myself padding in case this bounces aggressively at the open.

First Covers To Ensure Profit

So the $14.50 line just broke. I decided to trim some of my position for a small win; if the stock bounces, I will be able to attack back. I’m not looking at my P&L. I know it’s sick looking at $65,000 before the market opens, but I think this could be a big winner.

I pulled up the five-minute chart here to draw more areas of interest and know where to cover. It is not a coincidence that I’m using this resistance to cover. Why? Resistance turns into support. I am using the chart to determine my entries and exits.

My next cover area will be around $14.

5 Minutes to Market Open

Trying to cover some more of the $14.37, but I didn’t get it. The market is going to open up here in five minutes.

I’m going to add back a little bit on this bounce. Remember what I mentioned?

The stock usually pushes pre-market and washes out at the open. So if this stock washes out at the open, I want to be able to lock in half of my position. So that in case it bounces, I have realized profits to pad me. And in case it takes more, so be it. At least I protected myself. So the market should be opening up here in three minutes.

Fantasy Orders

The market’s going to open up in 20 seconds. What I’m doing is setting fantasy orders.

Fantasy orders – preplanned limit orders to exit for a profit that:

If short, are…

- Placed under the bid to exit during the panic to increase odds of getting good executions

If long, are…

- Placed above the ask to exit during the rally to increase the odds of getting good executions

I placed my fantasy orders under the bid if this stock washes out fast at the open. I have open orders out to cover the position because sometimes these stocks move so fast that if we don’t have an order set, we might not get it.

Market Open

So I covered nearly half my position and locked in $41,000 in realized profits with another $40,000 in unrealized gains.

I want the stock to bounce ideally towards $15 because $15 was where it was rejected before. I want this thing to bounce towards $15, and I want to reload everything that I covered. So I covered about 70,000 shares on that dip, and I am still trying to cover some more.

Remember, if it tanks, I have no problem adding back. I want to protect myself. So I locked in $47,000. If something goes wrong, I have significant padding to offset it now.

I’m slowly adding in because I see this stock is being rejected, and the bounce is failing. These adds were a bit premature because I thought they would break the day’s low. That’s fine because I have some realized profits and a plan for the stock. I tried to cover a little bit earlier but could not fill it. So I stay calm and stick to my plan.

Recap The Plan For Market Open

My plan told me, “if this thing bounces, I am now okay scaling back into the position because the stock makes the same pattern every day.”

Let’s recap the characteristics of this stock:

- The stock was strong during pre-market.

- The stock tends to tank at the open.

- The stock rebounds at the open.

If that rebound fails, it is going to unwind.

So I am slowly starting to scale back into my position, not looking at my profits. I’m not looking at anything other than the fact that I want this thing to bounce toward $15. I want to bounce towards $15 to get people excited, and then I want them to pull the plug on it. Since I locked in such large profits at the open, I am comfortable and confident that I have room if things go wrong.

If you notice, $15 is the resistance area here. So it pushed toward $15 and got everyone excited. Then, the plug is pulled at $15, I started to reshort now. I feel I can be comfortable, confident, and aggressive.

So it ended up washing out the $14.50. Remember, $14.50 was the support from before. That will be a huge area of interest in the stock.

I will try to lock in some more profits to mitigate my risk.

I’m not sure if I’m going to get it or not.

I am using the weakness of the stock to cover my position and the strength to add to my position. I’m just repeating it over and over and over again.

Now, in a perfect scenario, what I would like to see is I want to see the stock push above $15 to persuade everyone that $16, $17, and $18 are coming. Then I want them to pull the plug on it.

Six Minutes After Market Open

Throughout this entire time, I am not looking at my profits. I am looking at the chart. I am looking at my plan. I am trying to trade the stock, not trade my profits.

Since I locked in such large profits in the open, I’m not panicking, hesitating, or worried.

“If you find yourself struggling or unable to be patient, it’s likely you haven’t locked in any profits.”

So I lock in profits on dips to be able to offset in case things go wrong. So remember, I want to see a push towards $15. and I want to see this thing slam right back down. I want everyone to get excited thinking that $16, $17, and $18 are coming. And then I want to see a massive death candle or massive rejection or something to signal, “hey, I’m right.”

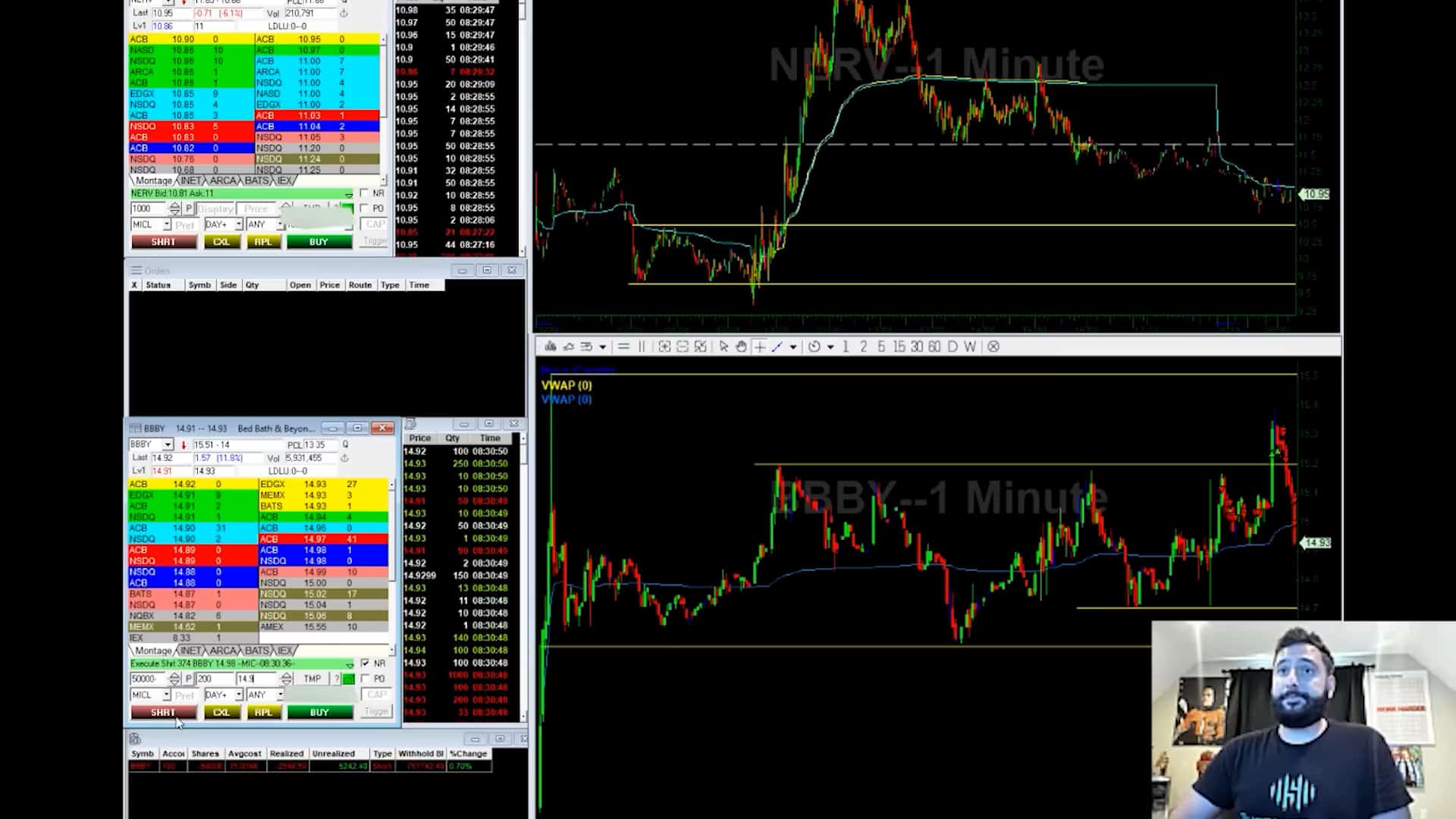

The Death Candle: The Beginning of The End

Now here’s the death candle. The entire push got rejected, but I don’t want to get too aggressive because I want to see the $14.50 and $14.40 levels break. We need to see that break because, if that breaks, everyone who bought at $15 is now underwater.

A full-size position for me would be around 200,000 shares on this stock, and I’m up to about 130,000. I still have enough room to add about 70,000 more, but I want to take it slow and wait for the stock to start playing games.

Now we’re at $14.30. So every single person who bought this ramp is now stuck and underwater. This is the exact signal that I want to see. I’m going to cover some at $14.37 to lock in some profits in case it decides to bounce one more time to $15. And if it tanks, I have no problem getting back in. So, I’m using the dip to exit pieces of my position.

I noticed the bounce is failing, so I’m trying to add my position back. I see that the bottom of the candle I added back was $14.21. So, I want to see a $14.21 break and another test of $14.

So as the stock starts to bounce, I’m slowly scaling back into my position. I want to scale back towards $14.40, $14.70, and $15. If it fails, it fails, but I want to slowly scale back in because I’m noticing that the bounces are getting weaker. So, remember, $14.21 was the bottom of that candle. So I want to see that candle break, and I want to see this thing test $14.

I am slowly scaling back in on the bounce. I’ve locked in $53,000 and have another $30,000 unrealized. I’m not worried right now. The stock is doing what I thought; the bounce is failing again. This is beautiful, and it couldn’t even bounce to VWAP. This tells me this stock is really weak.

$14.21 broke. What’s next? $14.10 is the low of the day. Can it break it? Boom! Now we’re at the low of the day. I’m up $53,000, plus another $71,000 waiting to be locked in.

Trading Size

You can’t just cover hundreds of thousands of shares when trading size. It would be best if you waited for liquidity spots on the stock; whole dollars or half dollars. And on this stock, $14 is a whole dollar mark. So I set an order to cover 70,000 shares, which is half my position at $14.

I know that is the best spot to get liquidity on the stock. I need people to slam $14, and I need stops to go off to be able to take off my monster position, or else I will be pushing the stock up myself.

So, if trading size,

-

- Look for key liquidity spots; whole and half dollar marks to exit your position.

Full Size

At this point, I ran out of locates. So, I’m sitting at the bid at $14 to cover half of my position because that’s the spot that will give me the most liquidity. I need that liquidity to exit, people to stop, and people to slam the bid into my order.

Come on! $14. The bounce is failing again. Come on! Do it, and boom! $14. I got that instantly. 70,000 shares executed in one second. It executed in one second because so many people were hitting the bid or stopping out, so I got a huge liquidity zone to cover my shares. I’m using this entire dip to cover my position.

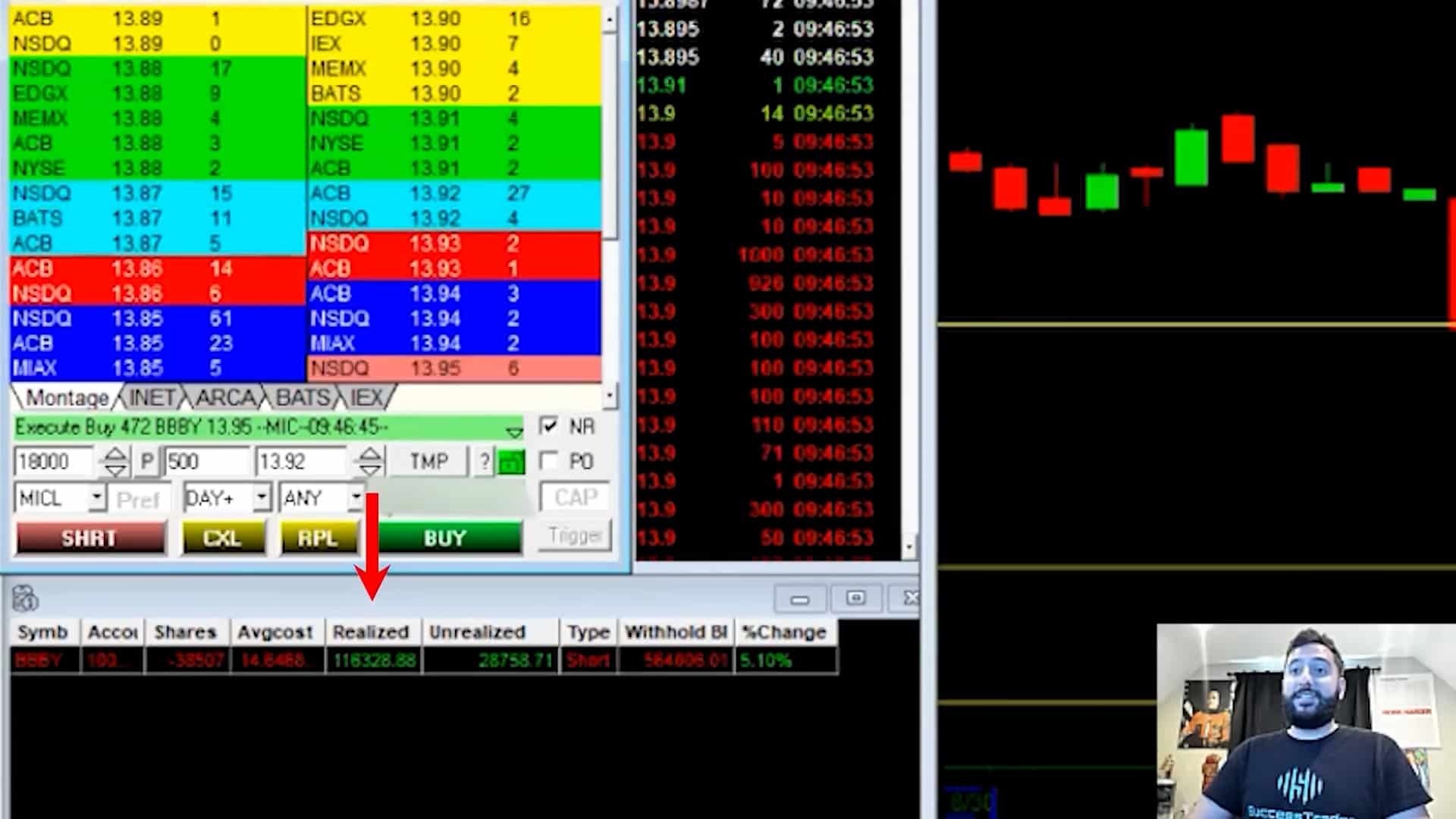

$116,000 Realized

I locked in $116,000 in realized profits and another $30,000 unrealized.

I’m covering into the panic as people are dumping it, and I use that as my opportunity to get out and lock in my gains. It has only been 17 minutes since the market opened. This trade took 17 minutes.

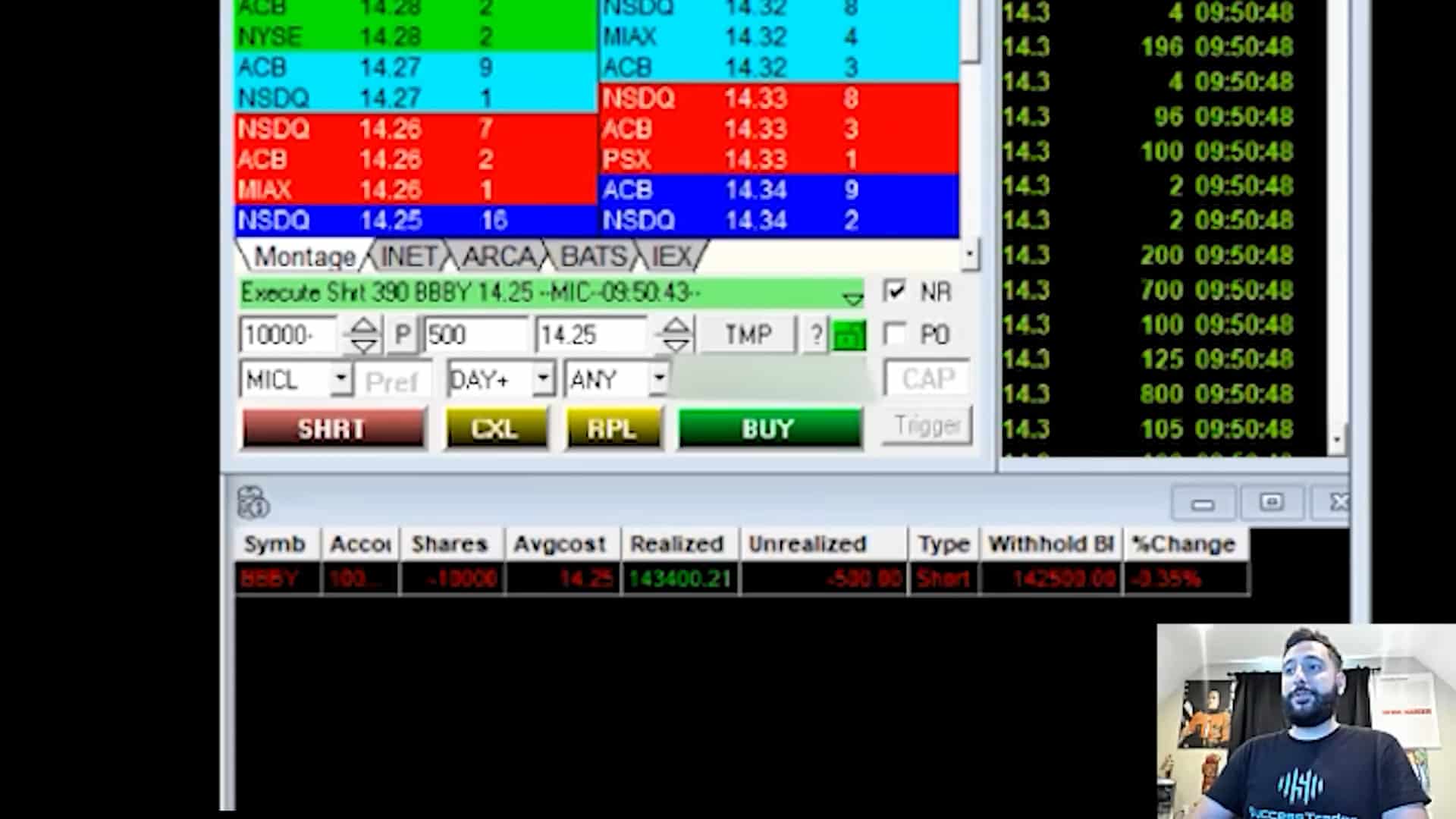

$143,000 Realized

I locked in $143,000. I said, “Hey, if this stock bounces, maybe I’ l take another scalp on it.”

The Scalp

The stock is starting to bounce, so I’m starting to scale back in slowly. I’m not going to use 150,000 shares like last time, but I might go up to 10, 20, or 30,000 on this bounce. Ideally, it gets up to $14.50 or $14.70. Notice the stock bounced over the same support line that I drew. That is why I covered it there. This is what we teach inside MIC. Watch the free 1-hour webinar where I go over more live trades.

I got about 10,000 shares on a $14.25 average. I would love to add around $14.50, but I’ll take the profits if this washes out.

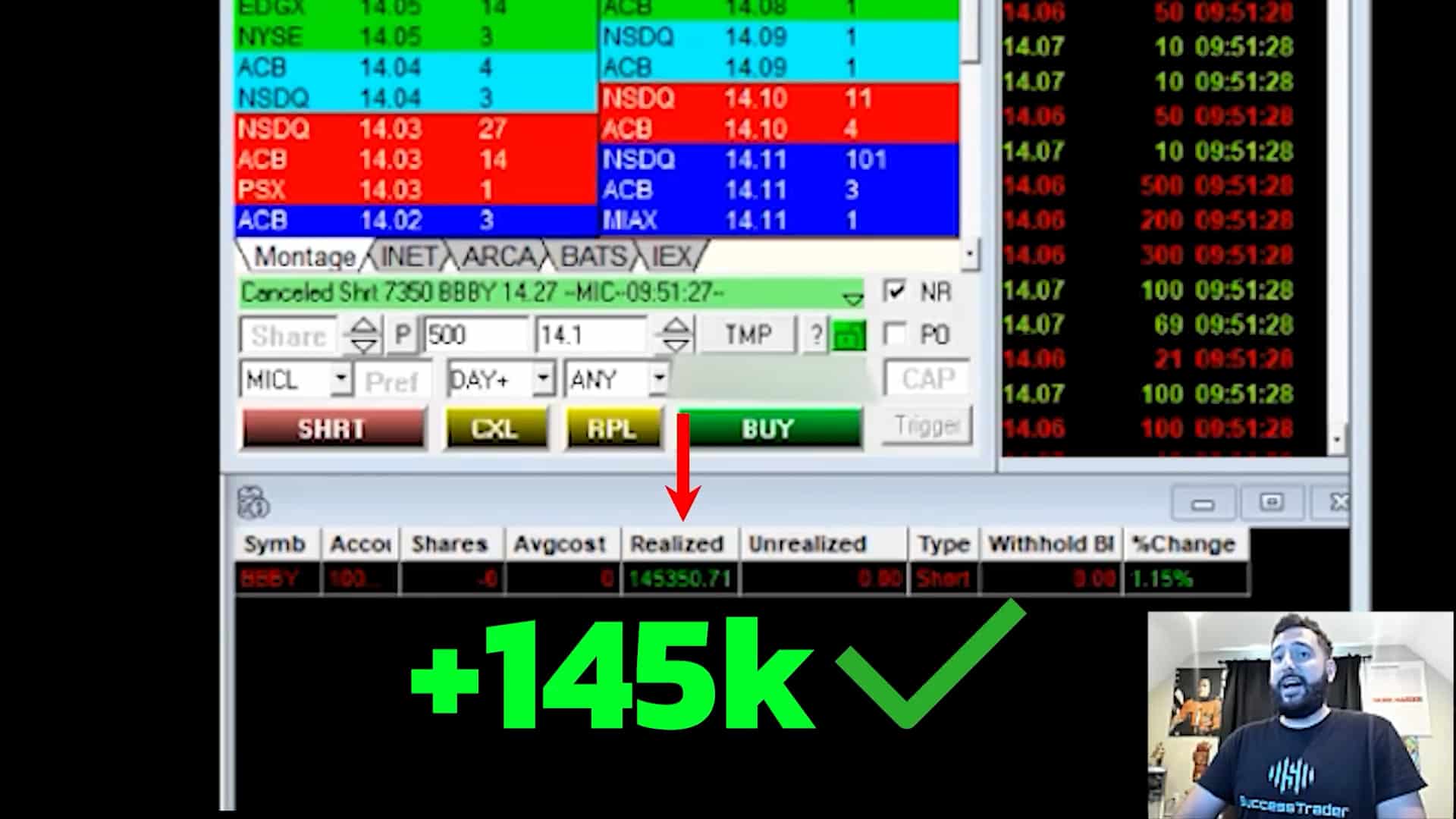

It started to pull back, so I’m trying to take my profits on the dip at $14.10. I’m not trying to get greedy, and 15 cents is not bad.

That’s $145,000 in just one day of trading the meme stocks. Let me show you what happened to the chart throughout the rest of the day.

The stock collapsed throughout the rest of the day. I got out around $14, but it went as low as $12. I could have made almost $300,000-$400,000 on this stock, but I screwed it up. It’s not so bad when you screw up and make hundreds of thousands of dollars. LOL!

What’s Next?

If you’re curious about my strategy and want to learn how to day trade for yourself, all you have to do is go to myinvestingclub.com/webinar and register for our free mentorship course. This is for non-mic members only. You will see my strategies, live trades, and my process revealed to you live. This course is only going to be available only for a limited time.

In the meantime, please subscribe, like, and leave a comment on the YouTube. And I’ll record some more live trades for you guys soon.

Thanks!

Alex